In the Philippines (and in all other countries), employers play an indispensable role in ensuring the welfare of their workforce by adhering to a range of legal and ethical obligations. Apart from the safe workplace and competitive compensation, the timely and accurate remittance of social security contributions is an equally important concern among employees. By fulfilling these, employers not only support their employees’ rights and well-being but also foster a productive and legally compliant work setting.

In this article, we’ll provide a semi-comprehensive guide to SSS employer registration, the first step to compliance with the social security laws and regulations. We’ll cover the documentary requirements, process, and some frequently asked questions on the importance of the registration. Read on and tell us in the comments how we can help you with your business and employer registration needs.

SSS Employer Registration FAQs

What is SSS Employer Registration?

SSS employer registration is the formal process by which an employer (business or individual) who hires and employs people registers with the Social Security System (SSS) in the Philippines. The registration is a crucial step for the issuance of an Employer ID Number and compliance with the social security regulations as provided in the Social Security Act of 2018 or RA 11199.

What is SSS?

Created by virtue of the Social Security Act of 1954, the Social Security System (SSS) administers social security protection to workers in the private sector by providing replacement income for workers in the events of death, disability, sickness, maternity, and retirement.

Who Requires SSS Employer Registration?

Under the Social Security Act, all employers are mandated to register their businesses with SSS by accomplishing the Employer Registration Form (SS Form R-1) and to report all their employees for SSS coverage using the Employment Report Form (SS Form R-1A) within 30 days from the actual employment date.

As defined by law, an employer is “any person, natural or juridical, domestic or foreign, who carries on in the Philippines any trade, business, industry, undertaking, or activity of any kind and uses the services of another person who is under his orders as regards to employment.”

What is the Importance of SSS Employer Registration?

On the part of the employers, the SSS employer registration translates to compliance with the Philippine labor laws and social security requirements, thus avoiding penalties and other legal repercussions. It also promotes the employer’s reputation, attracts top talents, and establishes groundwork for sustainable growth.

On the other hand, the registration ensures that the employees’ rights and access to social security benefits are safeguarded. It provides access to comprehensive social security coverage such as retirement, disability, sickness, maternity benefits, loan programs, and other financial assistance, especially during challenging times.

What are the Penalties for Non-Registration with SSS?

Failure or refusal to comply with the provisions of RA 11199 by the employer is punishable by a fine of not less than PHP5,000.00 nor more than PHP20,000.00, or imprisonment for not less than six (6) years and one (1) day nor more than twelve (12) years or both, at the discretion of the court.

However, if the violation consists in failure or refusal to register employees or himself, in case of the covered self-employed, or to deduct contributions from the employee’s compensation and remit the same to the SSS, the penalty shall be a fine of not less than PHP 5,000.00 nor more than PHP 20,000.00 and imprisonment for not less than six years and one day nor more than 12 years.

In case the employer deducted the SSS contribution or loan amortization from the employee’s salary/wages but failed to remit to SSS, the imposable penalty shall be that provided under Article 315 of the Revised Penal Code on Estafa which provides an imprisonment not exceeding twenty (20) years.

SSS Employer Registration Requirements

All registration forms are readily available for download from the official website of SSS. While the registration may also be processed online, these forms may be electronically, downloaded for printing, and finally uploaded to My.SSS.

SSS Form R-1 (Employer Registration Form)

This is the official form for the SSS employer registration of all business entities, such as sole proprietorships, partnerships, and corporations.

SSS Form R-1A (Employment Report)

This form serves as a report that contains the employment details and contributions of the newly hired employees. This is filed during the initial SSS employer registration and every time there are new employees.

SSS Form L-501 (Specimen Signature Card)

This form indicates the company or business officials who are authorized to certify and sign the documents on all social security matters.

SSS Web Registration for Employer Form

This form is for the employer registration to My.SSS (the SSS online service portal).

Supporting Documents

These include business registration documents, e.g., DTI Certificate of Registration, Business or Mayor’s Permit, SEC Articles of Incorporation, etc.

Authorization Letters and ID Cards

If the SSS employer registration will be processed by another person other than the company officer or employer, these are normally required to be presented at the SSS servicing branch.

Step-By-Step Guide to SSS Employer Registration

SSS employer registration is part of a broader company incorporation or business registration process in the Philippines. It is important to consider the entire process to know when the registration can already be made. Interestingly, registrations with the SSS, PhilHealth, and Pag-IBIG Fund may be processed simultaneously (Steps may vary if the registration is processed online).

1. Prepare all Documentary Requirements.

Fill out the required SSS forms (i.e., R-1, R-1A, L-501, and web registration) with complete and accurate information. It is best to allow another person or team to review the drafted forms. Supporting documents vary depending on the type of business or business structure. For instance, for a sole proprietorship, the DTI Certificate of Registration and Business or Mayor’s Permit must be attached.

2. File the Application with the SSS Servicing Branch (or My.SSS).

The SSS employer registration may be filed with any SSS servicing branch or better with the servicing branch having jurisdiction over the principal business address. After all, the initial or first remittance must be made at the latter. If the registration will be filed by a representative, an authorization letter and ID cards will be required, depending on circumstances. If the registration will be made online via My.SSS, the accomplished and signed SSS forms must be uploaded together with the supporting documents.

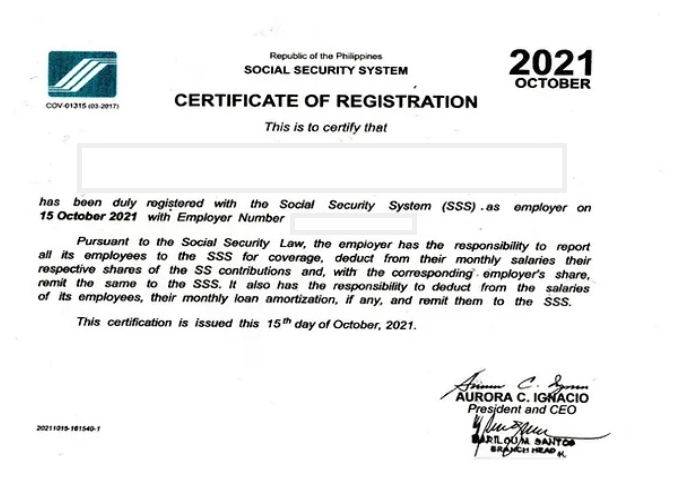

3. Receive the SSS Certificate of Registration.

Once all documentary requirements are evaluated, the SSS personnel will issue the SSS Certificate of Registration (COR) and return stamped copies of the filed forms. The SSS Employer ID Number is indicated in the forms. It is important to secure and keep the stamped forms, as they will serve as references in case of future corrections or amendments.

4. Wait for My.SSS Activation Link.

My.SSS is an online service portal of the enhanced SSS Website that allows SSS members and regular or household employers exclusive access to their social security records, to perform transactions online, and to download forms. SSS normally sends an email notification containing the activation link or account credentials one (1) to two (2) weeks after the approved registration.

5. Activate and Accomplish My.SSS Registration.

Once the activate link is received, the account password may already be set, after which managing the settings and exploring the platform features may be made.

The SSS Certificate of Registration (COR) is an official document showing that an employer is registered with the Social Security System (SSS) for employee contribution remittance.

Employers’ Post-Registration Obligations

The obligations of the employers do not end with the SSS employer registration. In order to keep a good standing with the agency, they must:

Maintain Compliance

Employers must regularly deduct and remit SSS contributions and loan payments from employees’ salaries, along with the employer’s shares. They must also submit various reportorial requirements to the agency.

Update Information

Employers must inform SSS of any changes in business details (e.g., business address, ownership structure, etc.) to keep records updated by filing the necessary amendment forms. They must also update employee details in the system for changes in personal information, salary adjustments, employment status, etc. Regular updates ensure accurate benefit processing and compliance with SSS regulations.

Handling Employee Queries and Issues

Employers must serve as intermediaries between the employees and the SSS, hence contacting or coordinating with the latter should there be queries and issues regarding contributions, employee records, benefit claims, and the like.

Businesses are legally obliged to register with the Social Security System (SSS), process the statutory contributions of their employees, and contribute to the broader social protection of the workforce in the private sector.

With the readily available SSS forms and minimal supporting documents required, the SSS employer registration can be processed in a matter of days, or a maximum of two (2) weeks, that is if the activation of the My.SSS account is included. Interestingly, it may be processed simultaneously with the PhilHealth and Pag-IBIG Fund employer registrations, thus making the wait time less of an issue.

… and you might just need our assistance.

FilePino is a one-stop-shop business consulting firm trusted by thousands of clients for their business formation and post-formation needs. We offer complete packages of business registration and business permit renewal services (i.e., SSS employer registration). With its sister companies and brands, we guarantee fast, efficient, and seamless fulfillment of your business service needs.

Ready to process your SSS employer registration? Set up a consultation with FilePino today! Call us at (02) 8478-5826 (landline) and 0917 892 2337 (mobile) or send an email to info@filepino.com.

9 Responses

How to look my ss number

Hi Alex! Thank you for your comment. Please visit your SSS servicing branch to verify your SS number. They’ll be able to assist you further.

Why don’t you make it easy to apply and register online as an employer of a household helper in the Philippines?

Hi Jun! We completely understand your concerns, and we agree that simplifying the process would be beneficial for many. While we are a business consulting firm and not directly affiliated with SSS, we can certainly assist you with the registration process. Feel free to reach out to us anytime, and we’ll be happy to guide you through the steps!

How about Pag-ibig and Philhealth

Hi Trish! You may read them here: https://www.filepino.com/pag-ibig-employer-registration-philippines/ and here: https://www.filepino.com/philhealth-employer-registration-philippines/. Thanks.

What are the requirements for small business with 3 employees only? I want them to have their sss contribution

hi.. is there a penalty if we don’t register immediately at SSS. My business was registered last 2018

Hi Genara! Thank you for your inquiry. Under the Social Security Act of 2018 (RA 11199), all employers must register with the SSS using the Employer Registration Form (SS Form R-1) and report employees for coverage via the Employment Report Form (SS Form R-1A) within 30 days of employment. Failure to comply may result in fines or penalties. We recommend coordinating with the SSS Servicing Branch that covers your business address, or consulting our HR experts for assistance. Feel free to reach us at (02) 8478-5826 (landline) or 0917 892 2337 (mobile), or email us at info@filepino.com.