The Philippines offers a vibrant business environment with opportunities spanning sectors like manufacturing, technology, and retail, significantly driven by young and dynamic consumers and workforce. However, navigating the complexities of business setup and local regulations can be challenging, especially if you’re unfamiliar with the legal and bureaucratic landscape.

If you’re a foreigner looking to enter the market quickly, then buying a shelf company can be an attractive option. It allows you to bypass the lengthy company incorporation process, establish presence and credibility with an aged entity, and start business operations right away. Careful consideration, however, is essential before moving forward with this option.

In this article, we’ll explore the key differences between a shelf company and a newly incorporated one, thus offering valuable insights, particularly for foreign entrepreneurs.

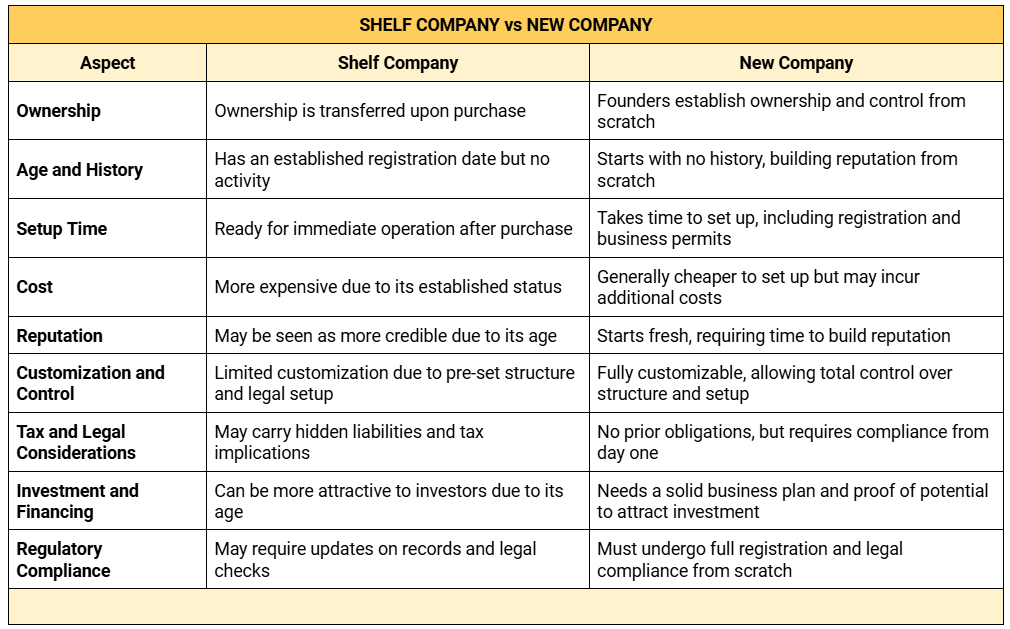

Key Differences Between a Shelf Company and a New Company

A shelf company (or aged company) is a pre-registered but inactive business entity that is available for sale and acquisition. It remains dormant on a ‘shelf’ until you purchase it, allowing you to skip the lengthy incorporation and registration processes and start your operations right away.

In contrast to a shelf company, a new company is a newly formed, incorporated, and registered entity. It is created from scratch and gives you full control over the business structure, operations, and branding.

Ownership

With a shelf company, ownership can be transferred almost immediately once you purchase it, offering a quick entry into the market. On the other hand, a new company requires you to establish ownership from the ground up, giving you full control from day one.

Age and History

A shelf company has a pre-established registration date, but it remains inactive, i.e., maybe for several years, with no prior business activities. This can be advantageous in certain industries where an older company might be seen as more credible. A new company, however, starts with no history, giving it a clean slate but also requiring time to build trust and reputation.

Setup Time

In certain circumstances, a shelf company allows you to make the business operational almost immediately after purchase, as it is already registered. In contrast, a new company normally takes several months or even a year to become operational, as it requires registration, documents, and permits.

Cost

As expected, a shelf company is typically more expensive due to its established nature and the fact that its ownership can be transferred quickly. In contrast, incorporating a new company is less costly but may involve additional expenses in terms of time and effort.

Reputation

In most cases, a shelf company is seen as more credible due to its age and registration date, and this helps secure contracts or attract investors. It may, however, take some time for a new company to build its reputation from the ground up.

Customization and Control

While a new company offers full control over almost every aspect of business to meet specific vision and goals, a shelf company often has limited flexibility in terms of its business model, structure, and legal setup.

Tax and Legal Considerations

Although a shelf company simply rests on a ‘shelf,’ it is not exempt from regulatory compliance, and such may result in hidden liabilities or tax implications. A new company, on the other hand, starts from scratch and with no prior obligations.

Investment and Financing

Investors may be drawn to shelf companies for their established nature, which signals stability and credibility. New companies, in contrast, often require more effort to attract investment, as investors typically look for a solid business plan before committing funds.

Regulatory Compliance

A shelf company may require updates to its records and compliance due to its previous inactivity. In contrast, a new company starts fresh and fully complies with current regulations. Clearly, the latter offers more control over legal and compliance processes from the start.

How to Buy a Shelf Company in the Philippines

Buying a shelf company can be a quick and efficient way to enter the Philippine market. Here are the six essential steps to guide you through the process:

1. Find a Reputable Service Provider.

Start by researching and selecting a reliable firm that specializes in selling shelf companies. Ensure that the provider has a proven track record and offers legitimate, properly registered companies for sale.

2. Select the Right Shelf Company.

Choose the shelf company that aligns with your business objectives, considering its legal structure, registration date, industry compatibility, and reputation. This will help ensure that the company meets your needs for credibility and operational flexibility.

3. Conduct Due Diligence.

Carefully review the company’s legal, financial, and compliance history to ensure there are no outstanding liabilities and avoid inheriting any hidden risks that could affect your business later on. You may hire a service provider to do the verification.

4. Negotiate Terms.

Discuss the price and terms of the sale with the provider, including the ownership transfer and any warranties or representations. Make sure all conditions are clearly outlined to avoid misunderstandings and protect your interests.

5. Transfer Ownership.

File the necessary documents with the relevant government authorities, such as the Securities and Exchange Commission (SEC), to officially transfer ownership of the company. This process makes you the legal owner and allows you to take over all aspects of the business.

6. Update Records and Obtain Permits.

Update the company’s records with the relevant agencies to reflect the new ownership. Also, maintain ongoing regulatory compliance to prevent penalties and legal complications. Regular monitoring of compliance requirements is essential to ensure smooth business operations and avoid disruptions.

At FilePino, we assist foreign nationals, expats, and businesses in the Philippines with purchasing shelf companies by providing expert legal and technical assistance throughout the process. While we do not sell shelf companies, we offer services such as shelf company selection assistance, drafting of purchase agreements, due diligence, ownership transfer, and nominee director services, among others.

We ensure all necessary filings with the SEC and other regulatory bodies, update shareholder and director records, and maintain compliance with local regulations. Our in-house legal team also offers consultation on the legal aspects of the transaction, ensuring a smooth and hassle-free process for investors.

How to Incorporate a Company (New) in the Philippines

Incorporating a new company in the Philippines requires following legal and regulatory steps to comply with local laws and establish a valid business. Here are the six key steps to incorporating a new company:

1. Choose a Business Structure.

Start with a decision on the appropriate business structure, such as a sole proprietorship, partnership, or corporation, based on your needs and goals. Each structure has its own unique legal requirements, tax implications, and ownership rules.

2. Register the Company Name.

Process the verification and reservation of your company name with the Securities and Exchange Commission (SEC). This ensures that the name is not identical or confusingly similar to those already registered.

3. Draft and File Incorporation Documents.

Prepare and file the necessary documents, such as the Articles of Incorporation (AOI), By-laws, and other required forms, with the SEC. The registration process may be done conveniently via the SEC’s Electronic Simplified Processing of Application for Registration of Company (eSPARC).

4. Secure Business Permits.

Obtain a Barangay Business Permit and Mayor’s Permit from the local government units (LGUs) where your business will operate. These permits are necessary to ensure that your business complies with local regulations and ordinances.

5. Register with the Bureau of Internal Revenue (BIR).

Simultaneously, register your company with the BIR to obtain a Taxpayer Identification Number (TIN) and a Certificate of Registration (COR). This allows you to comply with tax obligations and file returns accordingly.

6. Process Employer Registrations with Statutory Agencies.

Register your business with the Social Security System (SSS), Philippine Health Insurance Corporation (PhilHealth), and Pag-IBIG Fund. These registrations are necessary if you plan to hire employees, ensuring they have access to social security benefits and insurance.

We also specialize in company formation and business registration in the Philippines, offering a comprehensive range of services. Our expert team provides consultation on company formation, helping you select the right structure and explore tax incentives. We assist with SEC, DTI, or CDA registration, obtain necessary business permits (barangay and mayor’s permits), and handle BIR registration for tax compliance.

Additionally, we offer support in registering with social security agencies (SSS, PhilHealth, Pag-IBIG) and obtaining special licenses like PEZA, BOI, FDA, BOC, POEA, and others, ensuring full legal compliance and business growth.

Why It Is Better to Just Incorporate a New Company

Buying a shelf company may seem like a shortcut, but it comes with several disadvantages that can complicate the process and increase costs.

1. You need to purchase the shares from the current owners of the shelf company. The purchase normally requires processing an Electronic Certificate Authorizing Registration (eCAR), which typically takes 2 to 3 months to complete. Additionally, there are taxes to pay, such as the Capital Gains Tax (CGT) and Documentary Stamp Tax (DST). Thus, the processing timeline and financial costs can make the acquisition less straightforward.

2. The shelf company may have “skeletons in the closet.” As already mentioned, a shelf company, even in its dormant state in the “shelf” may still have unresolved regulatory compliance issues, which may include unfiled BIR returns, expired or non-compliant business permits, and other legal or financial liabilities. These “skeletons in the closet” can create additional burden for the new owners, as they must settle these obligations before moving forward with the company’s operations.

3. The corporate name or primary purpose may not align with the new owner’s goals. If the corporate name or purpose needs to be changed so as to align with the vision and goals, the new owners need to file an amended Articles of Incorporation (AOI) with the SEC. This process can be time-consuming, often taking up to a year on average and causing delays in rebranding and refocusing operations.

Based on the above discussion, buying a shelf company may still make sense if: (a) it has paid-in capital that allows you to pay less than its value, avoiding the need to infuse new capital; (b) its name and primary purpose already align with the new owners’ goals; and (c) the company is “clean” with all necessary government clearances in place.

Incorporating a new company thus provides greater control and customization over the business structure and operations. You can design the company according to your exact needs, such as ownership distribution, management roles, and business model. While the incorporation process is often time-consuming and involves a range of legal and regulatory steps, it allows you to build a fresh reputation from the ground up.

… and you might just need our assistance.

Ready to buy a shelf company or incorporate a new one in the Philippines? Set up a consultation with our business specialists to discuss service packages, scopes of work, service fees, and other matters! Call us at (02) 8478-5826 (landline) and 0917 892 2337 (mobile) or send an email to info@filepino.com.