To run your business in the Philippines, you need to register it with government agencies such as the Securities and Exchange Commission.

So, your corporation has already been registered with the Securities and Exchange Commission (SEC). What’s next?

Under the laws of the Philippines such as the Revised Corporation Code of the Philippines and the Securities Regulation Code, companies registered with the SEC must comply with the reportorial requirements.

Who needs to file reports with the SEC? The following are required to comply with SEC’s reportorial requirements:

- Corporations with Primary Licenses

- Corporations with Secondary Licenses

- Others (so long as required by the SEC to submit)

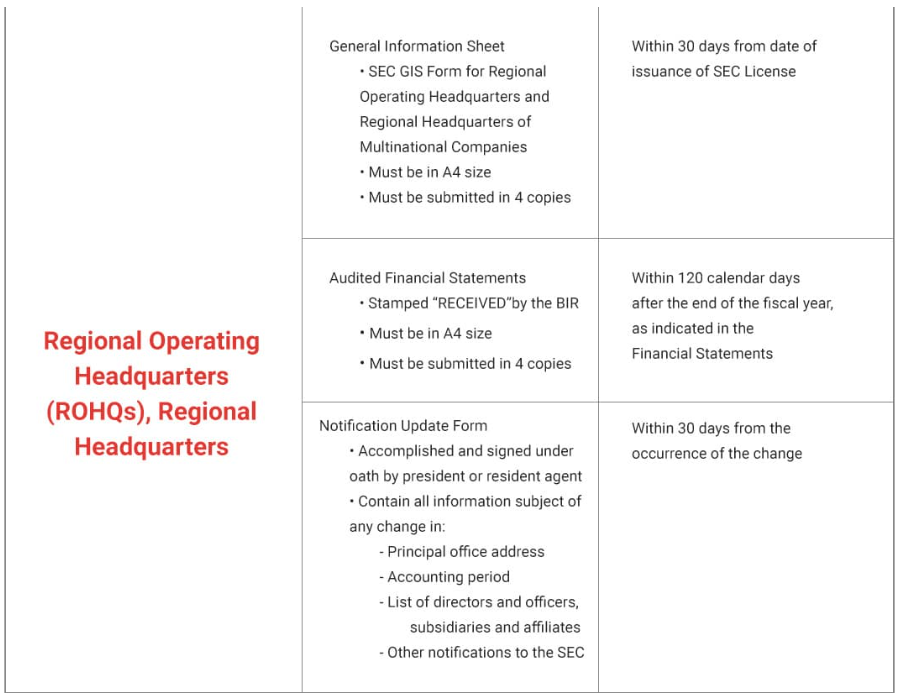

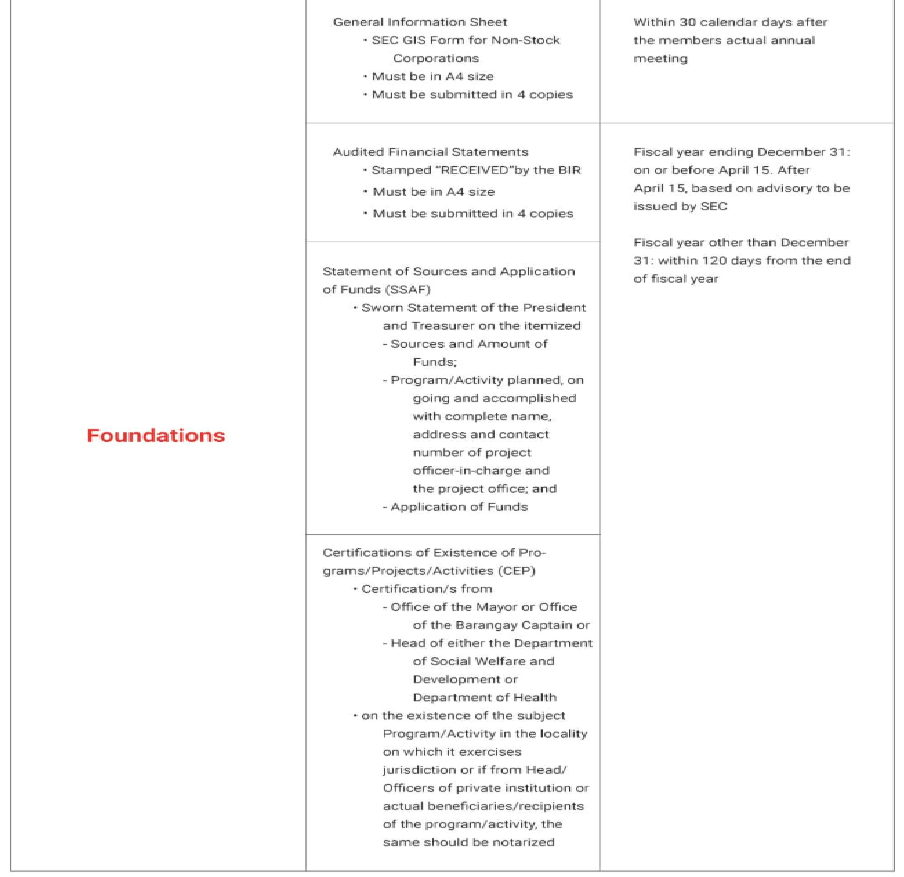

What are the reports that must be filed with the SEC? Reports which must be submitted to the SEC depends on the type of license it has. It also varies depending on the type of corporation.

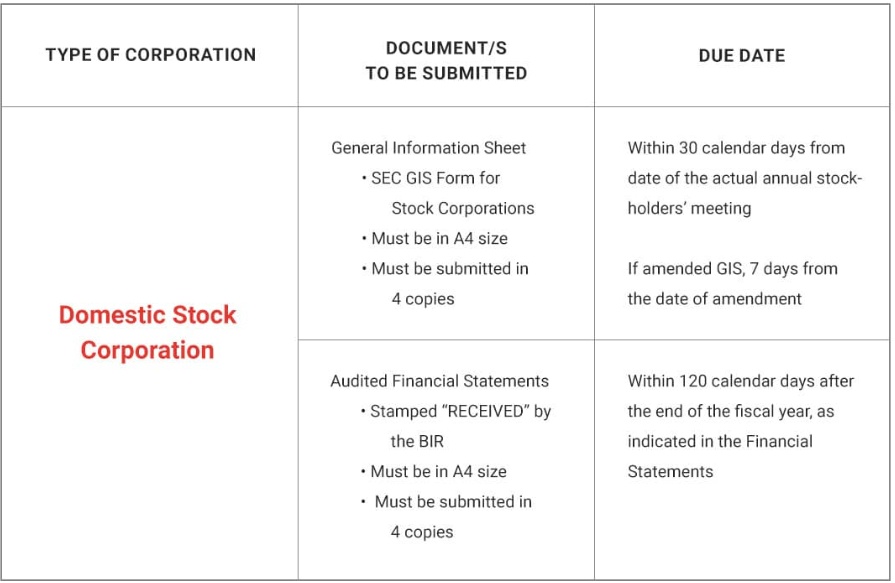

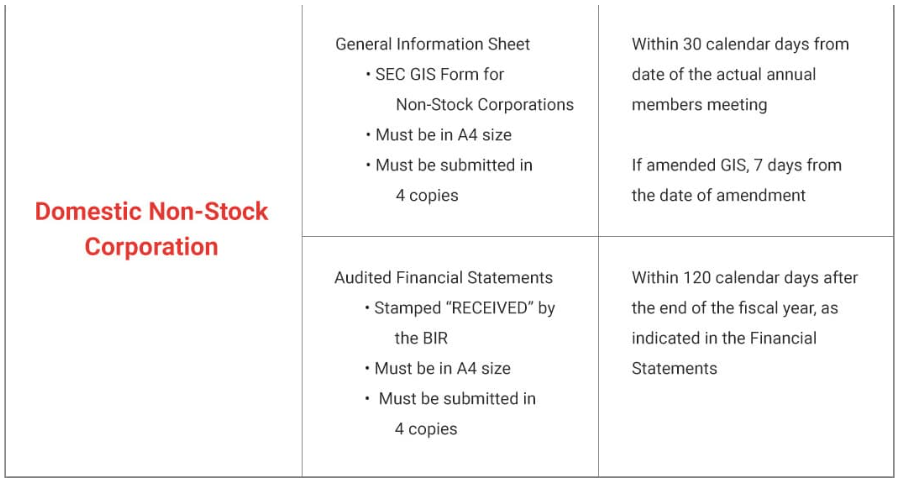

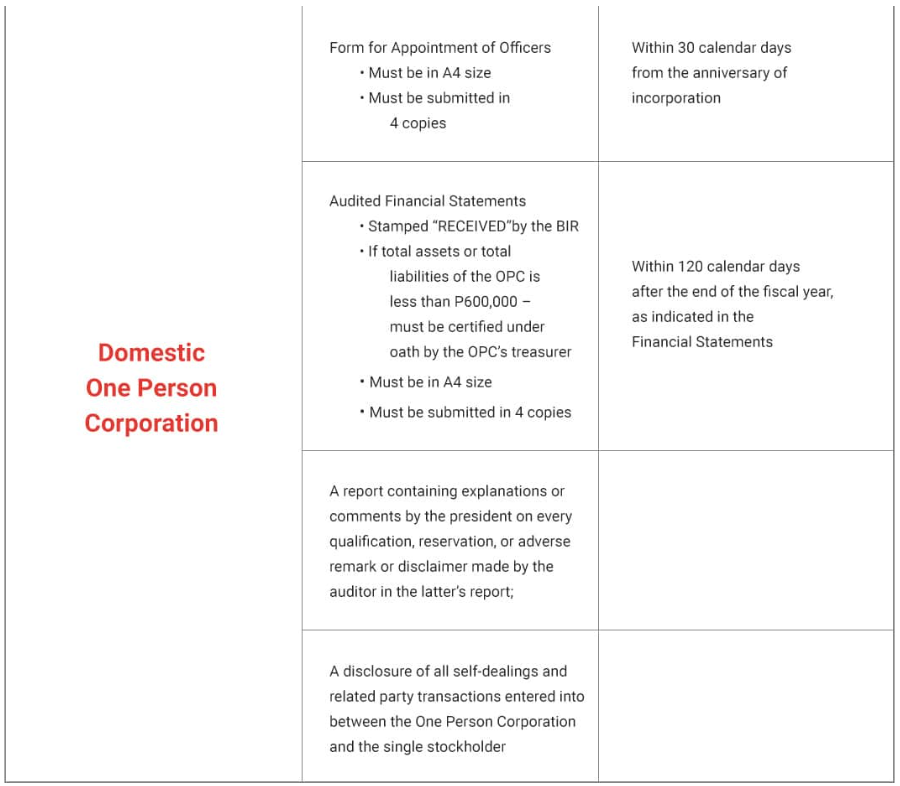

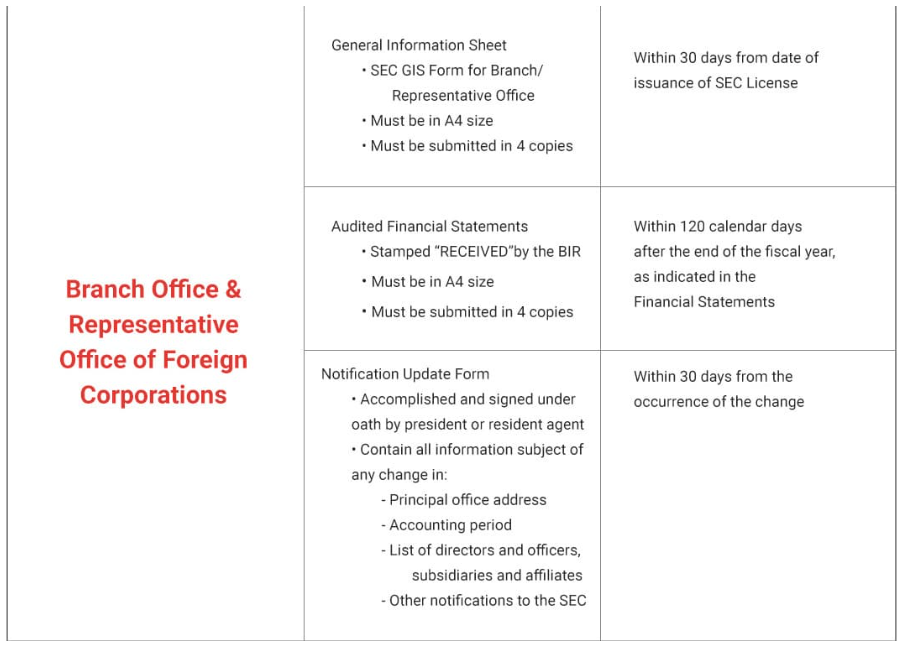

Corporations with Primary Licenses. As a general rule, corporations with primary licenses need to submit the following:

- General Information Sheet

- Audited Financial Statements

To be more specific, the following corporations with primary licenses must submit the following:

Corporations with Secondary Licenses. Corporations with secondary licenses are diverse, and each type requires a particular set of reportorial requirements. Such requirements can be found in the SEC website:

- Issuer of Securities

- Broker/Dealer(s) In Securities

- Government Securities Eligible Dealer

- Investment Houses/Underwriters of Securities

- Investment Company Adviser

- Mutual Fund Distributor

- Transfer Agent

- Financing Companies

- Lending Companies

- Operator of an ATS

- Registrar of Qualified Institutional Buyers

- Exchanges

- Self Regulatory Organization

- Clearing Agency

- Depositories

Comprehensive, Efficient, and Compliant

Let us handle your compliance needs with government agencies (e.g., SEC, BIR, etc.) so you can focus on growing your business without the worry of penalties or interruptions.

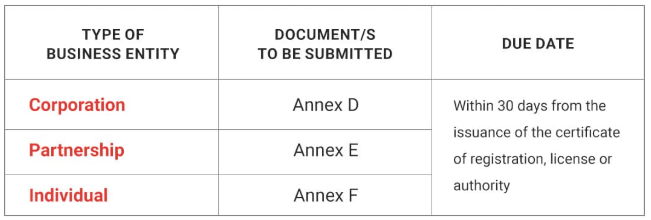

Other Reports. In addition to all of the above, Corporations (whether with a primary or secondary license), Partnerships, Associations, and Individuals are also required to comply with SEC Memorandum Circular No. 28 series of 2020 (MC 28). The latter are required to create and/or designate official and alternate email account addresses and cellphone numbers for transactions with the SEC.

Link of Document/s to be Submitted

The following documents are also required to be registered with the SEC:

- Stock and Transfer Book (for Stock corporations); and

- Membership Book (for Nonstock Corporations)

These must be registered within 30 calendar days from the issuance of the Certificate of Incorporation.

What happens if our corporation fails to submit these reportorial requirements? The reportorial requirements must be submitted annually and on time. Failure to do so three times, consecutively or intermittently, within a period of five years could have the corporation be placed under a delinquent status by the SEC.

Do you need help in filing your corporation’s reportorial requirements? We can assist you with completing and filing your documents with the SEC.

… and you might just need our assistance.

Need help with your SEC reportorial requirements? Set up a consultation with FilePino today! Call us at (02) 8478-5826 (landline) and 0917 892 2337 (mobile) or send an email to info@filepino.com.