Before the enactment of Republic Act 11032, otherwise known as the “Ease of Doing Business and Efficient Government Service Delivery Act of 2018,” many entrepreneurs and investors, both local and foreign, would often face bureaucratic hurdles and complex regulations when entering the Philippine business landscape.

With the landmark law, key reforms such as faster processing of business permits and licenses, standard turnaround time for government transactions, automated business registration processes, and anti-corruption policies are poised to benefit those in business and those who are planning to start a business.

A year after the passage of the landmark law, another important law was also signed, and it updated the almost thirty-nine (39)-year old Corporation Code of the Philippines. Now, one of the most important and interesting amendments in the Republic Act 11232, also known as the Revised Corporation Code (RCC), is the removal of the absolute requirement of having a minimum of five (5) incorporators for a corporation, thus introducing another business structure — One Person Corporation (OPC).

While most people may be familiar with a sole proprietorship, OPC still requires quite lengthy discussion, particularly on its features, pros and cons against other business entities, qualifications of incorporators and requirements, and many other legal provisions.

Well, whether you are a local entrepreneur or a foreign investor, we’ve got you covered, as this article provides a comprehensive guide on how to register a one person corporation (OPC) in the Philippines. Read on and tell us in the comments how we can help you with your business needs.

One Person Corporation (OPC)

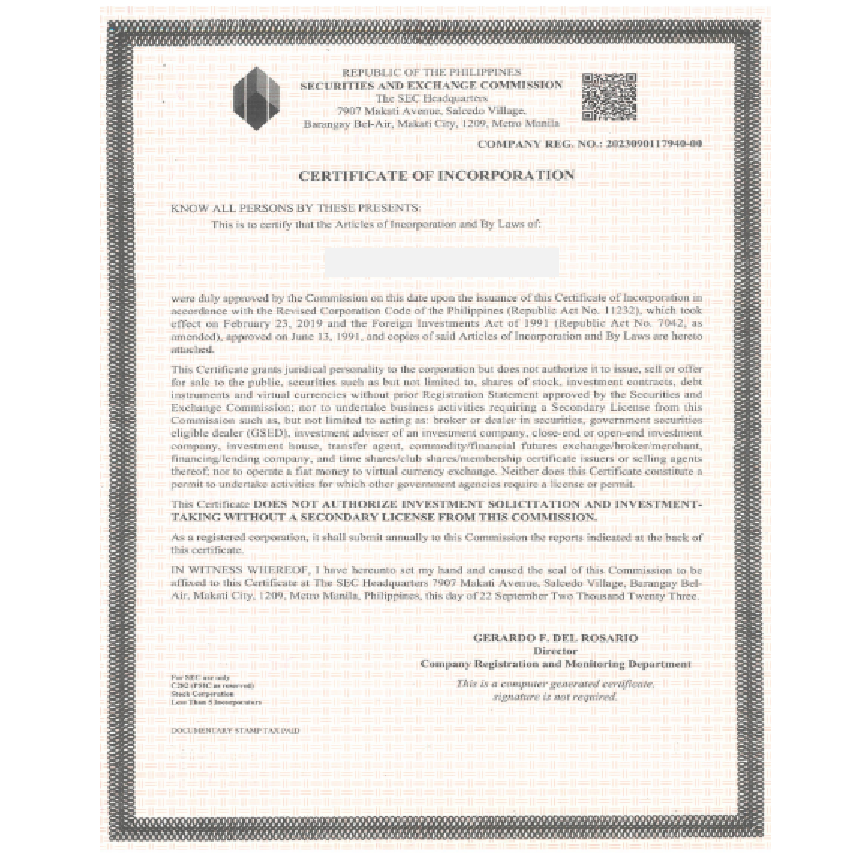

A One Person Corporation (OPC) is a corporation duly registered with the Securities and Exchange Commission (SEC) and with a single stockholder, who is also the sole incorporator, director, and president.

OPCs, as corporations, are separate juridical entities or personalities (independent existence) from their respective stockholders. In sole proprietorships, however, business liabilities extend to the sole proprietors’ personal assets as there is no legal distinction between the owner and the business.

Important Features of an OPC

One person corporations (OPCs) have features distinct from ordinary corporations and other business structures. Some of them are:

Single Stockholder

As the name suggests, an OPC may be formed by only one natural person, i.e., of legal age (18 and above), trust, or estate. The same stockholder also serves as the sole incorporator, director, and president. As prescribed by law, however, the single stockholder must appoint a nominee and an alternate nominee who will take over the corporation in case of the single stockholder’s death or incapacity. Equally, a treasurer, corporate secretary, and other officers, as may be necessary, must be appointed.

Limited Liability

OPCs in the Philippines can be compared with limited liability corporations (LLCs) in other countries, which means that the personal assets of the single stockholder are taken separately from those of the corporate entity. However, the single stockholder has the burden of affirmatively showing that the corporation is adequately financed.

Perpetual Existence

Unless stated in the Articles of Incorporation (AOI), an OPC may have a virtually unlimited life or an indefinite lifespan. In the first place, it does not hinge on the life of the single stockholder or incorporator. However, in the case of a trust or estate, its term of existence is co-terminus with the existence of the actual trust or estate.

No Minimum Capital Requirements

As provided in the RCC, an OPC is not required to have a minimum authorized capital stock except otherwise provided by special law. On the other hand, regular domestic and foreign corporations have minimum paid-up capital requirements based on industry and equity (e.g., a recruitment agency for local employment requires PHP 500,000).

Complete Business Control

Unlike a traditional or ordinary corporation, an OPC has only one director or president who has total control over all aspects of business operations. There are no other shareholders or board directors to make consensus decisions.

Convertible to an Ordinary Corporation (and vice versa)

As the law provides, an OPC may anytime be converted or restructured into an ordinary stock corporation after due notice to the SEC and compliance with all requirements. Equally, when a single stockholder acquires all stocks of an ordinary stock corporation, the latter may also be converted into an OPC.

Open to Foreign Investors (but with restrictions)

Foreign nationals may also set up an OPC in the Philippines, however with restrictions for certain types of industries. These restricted industries are provided in the Regular Foreign Investment Negative List, a government list used to regulate foreign ownership percentages. For instance, foreign nationals may only have up to twenty-five percent (25%) ownership in a private recruitment company for local or overseas jobs and up to thirty percent (30%) in advertising.

Display of “OPC” in the Corporate Name

Unlike ordinary corporations, which normally include words, such as ‘corporation’ and ‘incorporation’ or their abbreviations, in their names, OPCs require the suffix “OPC” either below or at the end of the corporate name. This, however, may create a slightly lower or negative impression that the corporation is managed by one and only person.

Basic OPC Qualifications and Requirements

Although an OPC should be easily registered and established given the legislative reforms, still there are strict qualifications and requirements that incorporators need to comply with, and these include:

Qualified Incorporators

An OPC with a single stockholder may only be incorporated and registered by a natural person (i.e., Filipino citizen or foreign national), trust, or an estate. Any natural person licensed to exercise a profession is not allowed to organize an OPC for the purpose of exercising such profession unless otherwise provided under special laws. Additionally, banks and quasi-banks, pre-need, trust, insurance, public and publicly-listed companies, and non-chartered government-owned and controlled corporations (GOCCs) are also not allowed.

Appointed Officers

The single stockholder and incorporator of an OPC must appoint a corporate secretary, who cannot be the same single stockholder and must be a Filipino citizen; a treasurer, who can be the same single stockholder and must be a resident of the Philippines; a nominee and alternate nominee; and other administrative officers, as deemed necessary. An Appointment Form must be filed within fifteen (15) days from the issuance of its Certificate of Incorporation.

Bond Requirements

If the same single stockholder and incorporator decides to be the self-appointed treasurer, he or she must deposit a surety bond based on the declared capital stock. For instance, if the authorized capital stock is between PHP 2,000,000 to PHP 3,000,000, the surety bond is equivalent to PHP 3,000,000. This, however, may be canceled upon proof of appointment of another or different person as the treasurer.

Documentary Requirements

An OPC, upon registration with the SEC, must file its Articles of Incorporation (AOI), which sets forth its primary purpose, principal office address, term of existence, name and details of the single stockholder, the nominee and alternate nominee, the authorized, subscribed, and paid-up capital, and other matters consistent with the law. Bylaws, however, are not required to submit and file.

Other documentary requirements include a Consent or Acceptance Letter from the nominee and alternate nominee, Proof of Authority to Act on Behalf of the Trust or Estate (for trusts and estates), Foreign Investments Act (FIA) Application Form (for foreign natural person), Affidavit of Undertaking to Change Company Name (in case not incorporated in the AOI), Tax Identification Number (TIN) for Filipino single stockholder and Tax Identification Number (TIN) or Passport Number for foreign single stockholder.

OPC Registration Process in the Philippines

Like the registration of ordinary corporations and partnerships with the SEC, the one person corporation (OPC) registration may also be initially done online through the SEC Electronic Simplified Processing of Application for Registration (eSPARC). The registration process takes the following steps:

1. Initial eSPARC Registration and Name Verification

To start the registration, access the eSPARC signup page and provide the initial OPC details for corporate name verification. This must be accomplished first to ensure that it is not duplicated or in conflict with those existing in the SEC database.

2. Encoding of Details

While waiting for the results of the name verification, proceed with the registration process and encode the details required. These include the business purpose, principal office address, contact information, and capital structure, among others. Upload also supporting documents, if necessary.

3. Submission of Documents for Pre-Approval

Once done with the encoding, generate the SEC registration documents. Download them, review the completeness and accuracy of the details, and proceed to submission for pre-approval.

4. Signing and Notarization

Always check the email for updates on the progress of the registration. Once the documents are approved by the SEC, they may already be downloaded for printing, signature, and notarization.

5. Uploading of Documents for Final Approval

All signed and notarized documents must be uploaded within thirty (30) days; otherwise, the registration will be canceled.

6. Payment of Fees

Once the uploaded documents are approved (final approval), the Payment Assessment Form (PAF) may already be downloaded, and the fees may then be paid. Refer also to the list of fees below.

7. Submission of Document Hard Copies

Within thirty (30) days from payment, the signed and notarized documents in hard copies must be submitted personally to the SEC Processing Office (SEC Main Office).

SEC Registration and Filing Fees

Based on the memorandum circular released by the SEC for the establishment of a one person corporation (OPC), the following are the registration and filing fees:

- Name Reservation Fee. This is PHP 100 per company name and/or trade name.

- Articles of Incorporation (AOI) Fee. This is equivalent to ⅕ of 1% of the authorized capital stock but not less than PHP 2,000.

- Legal Research Fee (LRF). This is 1% of the Registration or Filing Fee but not less than PHP 20.

- Foreign Investment Act (FIA) Fee (if applicable). This is PHP 3,000, if the single stockholder is a foreign national.

- Documentary Stamp. This costs PHP 30.

OPC Reportorial Requirements

An OPC must submit the following reportorial requirements to the SEC within the period required:

- Annual Audited Financial Statements (AFS) within 120 days from the end of its fiscal year as indicated in its Articles of Incorporation (AOI). If the total assets or total liabilities of the corporation are less than PHP 600,000, the financial statements may just be certified under oath by the treasurer;

- a report on all explanations or comments by the president on the qualification, reservation, or adverse remarks made by the auditor in the financial statements;

- a disclosure of all self-dealings and related party transactions entered into between the OPC and the single stockholder; and

- other reports as the SEC may require.

With the recent legislative reforms and introduction of a One Person Corporation (OPC), starting and running a business in the Philippines have become more inclusive and accessible for both local and foreign entrepreneurs and investors. With a single stockholder requirement, coupled with features, such as limited liability, no minimum capital requirements, and complete business control, among others, establishing an OPC makes a more attractive option against other business structures.

Understanding the qualifications, requirements, and procedural steps in registration with the SEC is crucial to have a smooth entry into the business world. However, as regulations and processes continue to evolve, it is important to stay informed and seek expert advice. e.g., from a reliable business consulting firm, to ensure compliance and business success.

… and you might just need our assistance.

Ready to register your business or company as a one person corporation? Set up a consultation with FilePino today! Call us at (02) 8478-5826 (landline) and 0917 892 2337 (mobile) or send an email to info@filepino.com.

2 Responses

Hi,

I had a contractor register my OPC, but I believe some steps may have been missed. I would like the registration to be audited to identify any incomplete steps. Could you please let me know what actions need to be taken to ensure compliance and provide me with a quote for the audit?

Hi Gabrella! Thank you very much for dropping an inquiry. For immediate expert assistance, you may set up a consultation with one of our specialists. You may call us at (02) 8478-5826 (landline) and 0917 892 2337 (mobile) or send an email to info@filepino.com. Thanks again.