The Securities and Exchange Commission (SEC) is the primary registrar and overseer of the corporate sector in the Philippines. It also supervises the capital market participants, the securities and investment instruments market, and protects the interest of the investing public.

As the registrar, it processes company incorporations and legitimizes juridical companies or entities upon the issuance of registration certificates and other documents. As the government agency responsible for giving life to the juridical personality of the company, it requires all registered corporations and partnerships, domestic or foreign, to submit periodic reportorial requirements. For corporations, the General Information Sheet (GIS) and Annual Financial Statements (AFS) are required to be submitted at least yearly.

In this article, we’ll focus on the General Information Sheet (GIS) and establish the importance of its on-time and proper filing with the commission. Read on and share your thoughts in the comments.

General Information Sheet (GIS)

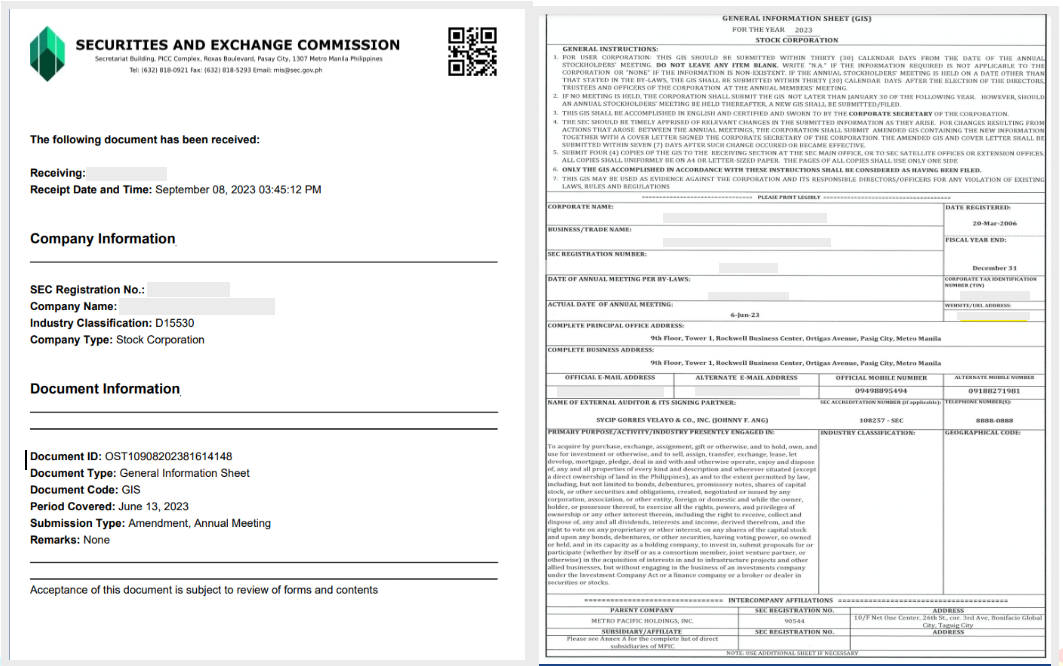

A General Information Sheet (GIS) is an annual reportorial requirement, signed and attested by the corporate secretary, that provides a snapshot of the corporation’s current status. Its filing with the Securities and Exchange Commission (SEC) is pursuant to the provisions of Republic Act 11232, also known as the “Revised Corporation Code of the Philippines.”

Its purpose is for the SEC to collect pertinent information about the registered corporations based on its mandate to ensure full and timely disclosure of material information, protect investors, and minimize fraudulent, manipulative devices, and practices that distort the free market.

It must be submitted within thirty (30) calendar days from the date of the actual annual stockholders’ meeting by the stock and non-stock corporations and from the anniversary date of the issuance of the SEC license by foreign corporations.

For one person corporations (OPCs), the counterpart of the GIS is the Appointment Form, which provides key information about the corporation, such as its appointed officers and other registration details, as signed and certified by the single stockholder or president. It must be submitted within fifteen (15) days from the issuance of the Certificate of Incorporation or within five (5) days after the change is reflected.

Based on Memorandum Circular No. 03 Series of 2021 (MC03-2021) issued by the SEC, the reportorial requirements must be filed through the Online Submission Tool (OST), now Electronic Filing and Submission Tool (eFAST), a web-based system that allows account creations for both corporations and authorized filers.

GIS Information Content

The 10-sheet MS Excel template for the General Information Sheet (GIS) (for stock corporations) is downloadable from the official website of the SEC. For non-stock corporations, there is also a 6-page document template.

- Basic Corporate Details. Basic information about the corporation, such as its corporate name, trade name, if any, SEC registration number, date of annual meeting, office address, contact details, subsidiaries, and affiliates, is contained in the first page of the document.

- Line of Business and AMLA Compliance. Whether the company and its line of business are covered under the Anti-Money Laundering Act (AMLA) and if it has complied with the requirements of Customer Due Diligence (CDD) or Know Your Customer (KYC), record keeping, and submission of reports under AMLA are contained in the succeeding page.

- Capital Structure. Types, numbers, and values of company shares for authorized, subscribed, and paid-up capital stocks are indicated in the page designated for capital structure.

- Directors and Officers. All directors and officers, together with their nationalities, addresses, Tax Identification Number (TIN), and other identity details, are also listed in the document.

- Stockholders. Up to twenty (20) stockholders, their stock positions, and TINs can be listed in the three pages designated. Beneficial owners must also be reported.

- Corporate Secretary’s Certification. The page contains the corporate secretary’s certification and attestation of the truthfulness and correctness of all information contained in the GIS, The same page is also reserved for notarization.

- Beneficial Ownership Declaration. The beneficial owner refers to any natural person who ultimately owns, controls, or exercises ultimate effective control over the corporation. Details, such as complete names, residential addresses, tax identification, ownership and voting rights, and others, are also indicated therein.

Comprehensive, Efficient, and Compliant

Let us handle your compliance needs with government agencies (e.g., SEC, BIR, etc.) so you can focus on growing your business without the worry of penalties or interruptions.

Importance of Annual GIS Filing

GIS filing may be just a once-a-year task, but it holds significant weight. It is crucial not just for legal and regulatory frameworks, but also for keeping the entirety of the corporation in good shape.

1. Mandatory Regulatory Requirement

Pursuant to Section 177 of Republic Act 11232, also known as the Revised Corporation Code of the Philippines, all corporations are mandated to submit annually a General Information Sheet (GIS) with the Securities and Exchange Commission (SEC). Additionally, this is also for the commission to perform its mandate of protecting the public from fraudulent or manipulative devices, practices that distort the free market, and money laundering activities.

2. Avoidance of Penalties

While the annual GIS filing is mandated by law, there are corresponding penalties for non-compliance. The SEC regulation provides that noncompliance, including non-submission and delayed submission of reportorial requirements, will result in the imposition of fines (i.e., within the range of PHP1,000 to PHP10,000 per report yearly), placing the corporation under a delinquent status if less than 5 years non-compliant, or revocation of the corporation’s Certificate of Incorporation if more than 5 years non-compliant. Additionally, the GIS may be used as evidence against the corporation and its responsible directors and officers for any violation of existing laws, rules, and regulations.

3. Updated Corporate Information

The GIS serves as a basis for the SEC to collect updated information about the registered corporations. These include, but are not limited to, the board of directors, officers, stockholders and their shareholdings, principal business address, and contact details – all which inform the SEC and the public about the changes that may affect the corporation’s status with the regulatory body and the decisions of the investors.

4. Documentary Requirement for Other Government Transactions

As previously mentioned, the SEC is the primary registrar and overseer of the corporate sector in the Philippines. Before major changes in status, e.g., change of line of business, change of address, addition of names doing business as (DBA), etc., registered corporations must make necessary filings first with the SEC, including the GIS filing, in order to proceed to the processing of documents with other agencies, such as the BIR, LGU, and other statutory agencies.

5. Efficient Corporate Housekeeping

On-time submission of the GIS, along with other reportorial requirements, that contain correct, complete, and accurate information, is a clear manifestation of efficient corporate housekeeping. Not only about the organized and secure maintenance of records, corporate housekeeping also holds together the legal and operational fabric of the corporation, including its compliance with government regulatory bodies.

6. Commitment to Good Corporate Governance and Transparency

Not only does it relate to the efficiency of corporate housekeeping, but it also mirrors the commitment to good corporate governance and transparency. Corporate governance lays the foundation for the organization’s approach to all business activities. With transparency, it helps build trust with the public, particularly the investors, who will develop a clear idea of the corporation’s direction and business integrity.

7. More Investments and Long-Term Success

Efficient housekeeping, good corporate governance, and transparency are equally important for both public and private corporations. For public ones, the financial robustness and growth potential, which are documented in the Annual Financial Statements (AFS) and GIS, will likely attract more investors. Private corporations, although not always facing regulatory scrutiny or needing to always answer to shareholders, should base their performance on strategically sound and transparent business operations, which may further influence their access to capital and additional investments.

The annual filing of a General Information Sheet (GIS) with the Securities and Exchange Commission (SEC) in the Philippines is mandated by law for all registered corporations, i.e., domestic and foreign. This provides the SEC, the investing public, and stakeholders with updated information about corporate structure, ownership, and management, among others, which translates to trust and credibility in the market. With on-time and proper filing, corporations ensure compliance with the legal and regulatory frameworks, avoid penalties, and demonstrate efficient housekeeping, good governance, and transparency — all which may lead to attracting more investors, driving growth, and keeping the business sustainable.

… and you might just need our assistance.

Need help with your GIS filing and other corporate housekeeping tasks? Set up a consultation with FilePino today! Call us at (02) 8478-5826 (landline) and 0917 892 2337 (mobile) or send an email to info@filepino.com.

15 Responses

Hi! already contacted their contact number, and may available staff naman po nag accommodate ng inquiry and nasagot nmn po 🙂

Happy na nakita ko online yung updates nila regarding GIS submission 🙂

Thank you Filepino!

You’re very welcome, Kimberly! If you have any more questions or need further assistance, feel free to reach out. We’re here to help!

My GIS

Hi Rudelyn! Thank you for dropping a comment. May we know the details of your concern or inquiry?

Please advice what GIS form will going to use this year for GIS reporting for non stock corporation.

Is that 2019 form or 2020 form.

Please help me.

Thank you

Hi good day, thank you very much for the very helpful information. can you help me? We are about to submit for the first time to SEC GIS. what are the requirement. Thank you in advance

Hi good day, thank you this very full help information, can you help me ..

were about to submit for the first time to SEC GIS And FS .. What are the requirements . thank you so much in advance.

Hi! SEC reportorial requirements are filed via SEC eFAST. You might want to avail our GIS and AFS filing services. Set up a consultation with FilePino today! Call us at (02) 8478-5826 (landline) and 0917 892 2337 (mobile) or send an email to info@filepino.com.

firstimer to submit SEC GIS

how to fill up the forms.. and what are the forms needed.. thanks

Hi Sec, Required to submit the gis and fs for our association.

Thank you for this link , it is easy to everyone to find what documents is required..

thank you for this very useful to all assocition to contact SEC, and their requirements to availed fast..

Hi! May I know where I can download the latest GIS form?

Hi Vander! Thank you for reaching out. You can visit the SEC website at https://www.sec.gov.ph and use the search feature to find and download the General Information Sheet (GIS) template.

For your convenience, we also offer GIS filing services to help you stay compliant with SEC reportorial requirements. If you’re interested, feel free to contact us at (02) 8478-5826 (landline), 0917 892 2337 (mobile), or email us at info@filepino.com. We’re here to help!