Starting a business in the Philippines offers promising opportunities, thanks to its strategic location in Southeast Asia, sustained economic growth, and a rising middle class. With government efforts to ease regulations for foreign investments, the country has become an attractive destination for entrepreneurs, particularly in industries such as business process outsourcing (BPO), manufacturing, and tourism.

If you’re looking to incorporate a company or expand your business presence in the Philippines, this guide will walk you through the process of setting up and registering a domestic corporation step by step while addressing key questions along the way.

What is a Domestic Corporation?

A Domestic Corporation is a company incorporated, registered, and operating under Philippine laws. As a corporation, it is “an artificial being created by operation of law, having the right of succession and the powers, attributes, and properties expressly authorized by law or incidental to its existence (Sec. 2, Revised Corporation Code).”

While the Philippines does not have a legal concept of Limited Liability Company (LCC) or Private Limited Company (PLC), which combines the characteristics of a corporation with those of a partnership or sole proprietorship, a domestic corporation is the closest equivalent under Philippine laws. Like LLCs, it has a distinct juridical personality separate from its stockholders and affiliated entities and is responsible for its own liabilities and obligations.

Domestic Versus Foreign Corporations

While a domestic corporation is incorporated and operates within the national jurisdiction under Philippine laws, a foreign corporation is incorporated outside of the Philippines but registered with the Securities and Exchange Commission (SEC) to operate in the country, typically as a branch office, representative office, or regional operating headquarters. It is, however, subject to restrictions outlined in the Foreign Investment Negative List (FINL), which limit its participation in certain industries.

Generally, foreign corporations are taxed only on income derived from Philippine sources and may face more stringent operational regulations depending on their business structure. They also have limited liability, but their scope of operations is more constrained compared to domestic corporations.

Key Features of a Domestic Corporation

A domestic corporation in the Philippines has several key features that define its structure, ownership, and business operations within the country.

Separate Legal Entity and Limited Liability

A domestic corporation is a separate legal entity from its shareholders and has the ability to own properties, incur debts, and enter contracts in its own name. While shareholders have limited liability and their personal assets are protected, the risk is generally limited to the amount they invested in the corporation.

Company Incorporation and Registration

A domestic corporation must be duly incorporated and registered with the Securities and Exchange Commission (SEC), the Bureau of Internal Revenue (BIR), local government units (LGUs), and statutory agencies (i.e., SSS, PhilHealth, and Pag-IBIG Fund), i.e., if there will be employees.

Flexible Ownership Structure

The extent of a domestic corporation’s participation in business activities in the Philippines depends on the nationality of its shareholders. It can be 100% Filipino-owned, 60% Filipino-owned with 40% foreign ownership, or have 40.01% to 100% foreign ownership.

Domestic corporations that are fully Filipino-owned can operate in any industry. However, those with foreign shareholders are restricted from engaging in sectors listed in the FINL, which outlines areas with limitations on foreign investment.

Minimum Number of Incorporators

The RCC (R.A. 11232) has also reduced the minimum number of incorporators for a domestic corporation from five (5) to two (2), with a maximum number of fifteen (15). Each incorporator, which can either be a natural or juridical, local or foreign person, must have at least one (1) share of the corporation’s capital stock.

Required Corporate Officers

Upon incorporation, a domestic corporation must fill four (4) key officers: a president, who must be both a director and shareholder with at least a share; a corporate secretary, who must be a Filipino citizen and a local resident; a treasurer, who can be a foreigner but must be a local resident; and a compliance officer.

Minimum Capital Requirements

Domestic corporations with 100% Filipino ownership or less than 40% foreign equity need a minimum paid-up capital of just US$ 100 (or PHP 5,000). The same applies to those that export at least 60% of their products. Those considered pioneers of Filipino industry, employing at least fifty (50) Filipino workers, or using advanced technology require only a capitalization of US$ 100,000.

However, corporations with over 40% foreign equity must have a capitalization of at least US$ 200,000, just as certain industries, such as banking and telecommunications, may have higher capitalization requirements.

Corporate Income Taxation

Domestic corporations in the Philippines are subject to Corporate Income Tax (CIT) on their taxable income, with the general rate set at 25% as of 2025. However, this rate can vary based on the business type and applicable tax laws. They may also be subject to other taxes, such as the Value-Added Tax (VAT), Withholding Tax on certain payments, and local business taxes imposed by LGUs.

Annual Reporting and Auditing

Domestic corporations must submit an annual financial report to the SEC, undergo auditing by a certified public accountant (CPA), hold an annual stockholders’ meeting, and file annual tax returns with the BIR.

Perpetual Existence

Unlike other business structures, such as sole proprietorships and partnerships, domestic corporations can have perpetual existence or continue operating even if the shareholders or directors change, unless they are dissolved or terminated by the SEC.

Franchising and Special Licenses

Domestic corporations planning to operate in specific industries may require special licenses or franchises from the government agencies. For instance, businesses in sectors like telecommunications, energy, and transportation need to secure appropriate government permits before they can operate.

Dissolution

Domestic corporations can be dissolved either voluntarily by the shareholders or involuntarily by the SEC for reasons such as failure to file annual reports or non-compliance with legal requirements. The dissolution process usually involves settling debts, distributing remaining assets, and filing appropriate documentation with the SEC.

How to Register a Domestic Corporation in the Philippines

To register a domestic corporation in the Philippines, follow these key steps to ensure full compliance with local laws and regulations:

1. Verify and Reserve a Company Name.

The first step to incorporating a domestic corporation in the Philippines is to decide on a unique corporate name, verify its availability, and have it reserved with the SEC through its online verification and reservation system.

2. Accomplish the Online SEC Registration.

After name verification and reservation, you must complete the online SEC registration through the Electronic Simplified Processing of Application for Registration of Company (eSPARC) and submit all duly signed and notarized documentary requirements, including:

- Articles of Incorporation (AOI), which document the creation of the company and define its purpose, structure, and other key information;

- Company By-Laws, that outline the rules that govern the company’s internal operations and management;

- Treasurer’s Affidavit, verifying the subscription and payment of the corporation’s capital stock;

- Bank Certificate, showing the bank deposit of the new company’s paid-up capital;

- Proof of Address, which can be a lease contract or property title for the corporation’s physical or virtual office address;

- Endorsements, Clearances (if applicable), or secondary permits obtained from the government agencies overseeing regulated sectors; and

- Other additional documents.

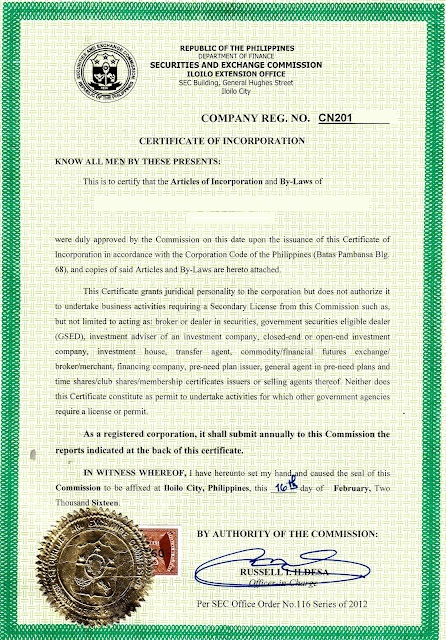

The SEC Certificate of Incorporation is an official document issued by the Securities and Exchange Commission (SEC), confirming the legal registration and existence of a domestic corporation in the Philippines.

3. Register the Stock and Transfer Books.

After securing the SEC Certificate of Incorporation, the domestic corporation must also register its Stock and Transfer Book (STB) with the SEC. STB is a mandatory record maintained by SEC-registered corporations to track the ownership of shares, thus efficiently managing the issuance of new shares, dividend payments, and other shareholder-related matters.

4. Obtain the BIR Certificate of Registration (COR).

Apply for registration with the Bureau of Internal Revenue (BIR), the tax authority in the Philippines, to obtain a BIR Certificate of Registration (COR), which contains the company’s Taxpayer Identification Number (TIN), VAT registration (if applicable), and other tax details. The domestic corporation must also register its books of accounts, print official receipts and invoices according to the agency standards, and comply with other tax regulations.

5. Secure Business Permits.

While registering with the BIR, simultaneously process the application for business permits with the LGUs. The two main permits required are the Barangay Business permit and the Mayor’s Permit. Other necessary permits and clearances include the Locational Clearance, Zoning Certificate, Fire Safety and Inspection Certificate (FSIC), and Sanitary Permit.

6. Apply for Secondary Licenses (if applicable).

If the domestic corporation will engage in regulated sectors (e.g., banking, insurance, pharmaceuticals, or lending), it is mandatory to apply for secondary licenses from the relevant regulatory bodies (e.g., the Bangko Sentral ng Pilipinas (BSP) for banking, the Food and Drug Administration (FDA) for pharmaceuticals, etc.).

7. Process Employer Registrations with Statutory Agencies.

Finally, the domestic corporation must register with statutory agencies, such as the Social Security System (SSS), PhilHealth, and Pag-IBIG Fund for employee benefits and compliance with labor and social security laws and regulations.

By following these steps, a domestic corporation in the Philippines can be legally registered, authorized to operate, and meet all necessary local regulations, tax requirements, and business permits. Completing this process not only establishes a strong legal foundation but also paves the way for smooth and successful business operations.

… and you might just need our assistance.

At FilePino, we simplify the process of registering your domestic corporation, ensuring compliance with all legal requirements. Our team of experts provides end-to-end support—from registration to regulatory compliance—so you can focus on your investments and growth strategies.

Ready to register a domestic corporation in the Philippines? Set up a consultation with FilePino today! Call us at (02) 8478-5826 (landline) and 0917 892 2337 (mobile) or send an email to info@filepino.com.