Business registration and company incorporation are terms often used interchangeably, but they technically refer to two different stages in the process of setting up your business. Incorporation creates your legal entity (like a corporation), while business registration ensures it meets local regulations as you obtain all necessary permits and licenses.

Now, if you’re looking for a practical and comprehensive guide to business registration, you’ve come to the right page—or if you prefer to skip the long read, you might want to consider our expert service. We can guide you personally through the complex requirements and processes. Interested? Check out our business registration service page or get in touch with our specialists today!

Steps for Business Registration in the Philippines

Business registration in the Philippines can be overwhelming, especially for first-time entrepreneurs and foreigners. With the complex regulations and bureaucratic intricacies, it often takes longer to complete than expected. Here’s a step-by-step guide to business registration:

1. Register with SEC, DTI, or CDA.

First, you must register your business (including your company name) with the appropriate regulatory body: Department of Trade and Industry (DTI) for sole proprietorships; Securities and Exchange Commission (SEC) for partnerships and corporations; and Cooperative Development Authority (CDA) for cooperatives.

2. Obtain Barangay Clearance and Mayor’s Permit.

Next, proceed to the Barangay Hall or Office of the Barangay Captain of the barangay with jurisdiction over your business address. Submit the requirements and pay the assessed fees for your Barangay Business Clearance.

Afterward, process all the necessary clearances, certificates, and fee payments for your application for an LGU Business Permit or Mayor’s Permit through your city or municipality’s Business Permits and Licensing Office (BPLO) or at a Business One-Stop Shop (BOSS).

3. Register with BIR.

While applying for a Mayor’s Permit, you can simultaneously register your business with the Bureau of Internal Revenue (BIR) for the issuance of a Taxpayer Identification Number (TIN), a BIR Certificate of Registration (COR), and other tax-compliance documents.

4. Process Employer Registrations.

If you will be hiring employees soon, then you must also start processing your employer registrations with statutory agencies, namely the Social Security System (SSS), Philippine Health Insurance Corporation (PhilHealth), and Home Development Mutual Fund (Pag-IBIG Fund).

5. Open a Corporate Bank Account.

Once your registration documents are complete, you can already open a corporate bank account in your business name. You should consider the availability of banking facilities, such as those for payroll, tax filing, and remittance of statutory contributions.

If your business will operate in regulated sectors, you will need to obtain secondary or special licenses from the relevant government agencies. For example, banking operations require registration with the Bangko Sentral ng Pilipinas (BSP), while pharmaceuticals need approval from the Food and Drug Administration (FDA).

During the early stages of your business, you may also want to explore government grants, tax exemptions, and other incentives that can ease your financial burden and support growth. For instance, your registrations with the Philippine Economic Zone Authority (PEZA) and Board of Investments (BOI) can provide both fiscal and non-fiscal incentives.

Business Registration Requirements in the Philippines

You must accomplish all the required registration forms and prepare the necessary supporting documents for each government agency involved in your business registration. Please note that these requirements may vary from time to time due to updates in rules and regulations.

SEC Registration Requirements

Your SEC registration through the SEC Electronic Simplified Processing of Application for Registration of Company (eSPARC) requires the following information to fill out the online form, along with the supporting documents to upload:

- Preferred Company Names (at least 3)

- Applicant or Authorized Representative’s Details

- Company Type and Industry (e.g., stock corporation, administrative and support service activities)

- Description of the Business (primary purpose)

- Complete Office Address (physical or virtual)

- Corporate Term (e.g., perpetual)

- Incorporators’ Details (i.e., their names, nationalities, addresses, etc.)

- Capitalization (i.e., authorized capital stock, paid-up capital, subscribed shares)

- Corporate Officers (i.e., president, treasurer, corporate secretary)

- Date of Annual General Meeting

- Fiscal Year

- Name Appeal Document (if necessary)

- Other pre-defined additional requirements (if necessary)

Business Permit Requirements

While documentary requirements and processes vary across LGUs, you must coordinate with your city or municipal Business Permits and Licensing Office (BPLO) for their complete list of business registration requirements. Generally, these include:

- BPLO Application Form

- Application Forms for Other Clearances and Permits

- Lease Contract (or other equivalent documents)

- Certificate of Occupancy

- SEC Certificate of Incorporation

- Locational Map (Google Maps)

- Pictures of Office Location (e.g., 3R images, outside and inside)

- Corporate Logo

- List of Employees (if any)

- Employees’ Medical Certificates (i.e., depending on the LGU)

- Other certificates and affidavits (i.e., depending on the LGU)

- Board Resolution and Secretary’s Certificate (especially if processed by an authorized representative)

BIR Registration Requirements

You may download the updated BIR forms from the agency’s official website and submit them to the respective Revenue District Office (RDO), together with the required supporting documents listed below:

- BIR Form 1903 (Application for Registration)

- BIR Form 1906 (Application for Authority to Print Receipts and Invoices)

- BIR Form 1905 (Application for Registration Information Update)

- Photocopy of SEC Certificate of Incorporation (for domestic corporations), or

- Photocopy of SEC Certificate of Recording (for partnerships)

- Photocopy of License to Do Business in the Philippines (for foreign corporations)

- Articles of Incorporation

- Notarized Lease Contract (or its equivalent documents)

- BIR Printed Receipts and Invoices (or final and clear sample of principal receipts and invoices)

- Books of Accounts

- Franchise Documents (e.g., Certificate of Public Convenience, for common carriers)

- Memorandum of Agreement (for joint ventures)

- Franchise Agreement (for franchise businesses)

- Certificate of Authority (for Barangay Micro Business Enterprises (BMBE) registered entity)

- Proof of Registration or Permit to Operate with BOI, BOI-ARMM, SBMA, BCDA, PEZA, etc. (if applicable)

- Board Resolutions and Secretary’s Certificates (especially if processed by an authorized representative)

SSS Employer Registration Requirements

You can download the SSS registration forms from the SSS official website or request copies from the nearest servicing branch in your area. Below are the documentary requirements:

- SSS Form R-1 (Employer Registration Form)

- SSS Form R-1A (Employment Report)

- SSS Form L-501 (Specimen Signature Card)

- SSS Web Registration for Employer Form

- List of Employees and Their Details

- Business Registration Documents (e.g., SEC Certificate, Articles of Incorporation, etc.)

- Authorization Letter (i.e., if processed by an authorized representative)

PhilHealth Employer Registration Requirements

Similar to your SSS employer registration, PhilHealth forms can be downloaded from the agency’s website or requested at any of their servicing branches. Below are the documentary requirements:

- ER1 (PhilHealth Employer Data Record)

- ER2 (PhilHealth Report on Employee-Members)

- POAF 001 (PhilHealth Online Access Form 001)

- PEER (PhilHealth Employer’s Engagement Representative) Information Sheet

- List of Employees and Their Details

- Business Registration Documents (e.g., SEC Certificate, Articles of Incorporation, etc.)

- Authorization Letter (i.e., if processed by an authorized representative)

Pag-IBIG Fund Employer Registration Requirements

While Pag-IBIG Fund regularly updates their forms, you better check their official website for the latest copies of the registration forms or request copies from the servicing branch near you. Below are the documentary requirements:

- EDF (Employer’s Data Form)

- Specimen Signature Form

- eSRS Employer Enrollment Form

- Employer’s Virtual Pag-IBIG Enrollment Form

- Duly Received/Stamped SSS Form R-1A

- Business Registration Documents (e.g., SEC Certificate, Articles of Incorporation, etc.)

- Authorization Letter (i.e., if processed by an authorized representative)

Corporate Bank Account Opening Requirements

You should expect that banks have different forms and requirements. You will need to accomplish only the forms provided by your preferred bank (and specific branch) and attach all supporting documents required:

- Customer Information Form

- Account Details Form

- Online Banking Form

- System Administrator Designation Form

- Signature Cards

- Corporate Secretary’s Certificate

- SEC Certificate of Incorporation

- Company Bylaws

- General Information Sheet (GIS)

- Photocopies of Valid IDs of Signatories

Aside from complex regulations and bureaucratic intricacies, you may also find the required documentation too extensive, with papers to gather here and there. But don’t worry—you have the options. You can leave all the paperwork to our legal and technical teams.

Business Registration Fees in the Philippines (Estimated)

You may have already checked other online sources for financial requirements for your business registration, but most of them seem difficult to comprehend. Now, here is a more straightforward breakdown of fees associated with transactions with various government agencies.

The sample below applies to a corporation with an authorized capital stock of PHP 1 million. If your capitalization is higher, expect higher fees. Equally, if it is just a sole proprietorship (the simplest business structure), then the fees will be significantly lower.

Sample Breakdown of Business Registration Fees | |

SEC Registration Fees | |

SEC Registration Fee (⅕ of 1% of the authorized capital) | PHP 2,000 |

Stock and Transfer Book (STB) Registration | PHP 150 |

Company Bylaws | PHP 1,000 |

Name Verification and Reservation | PHP 100 |

Documentary Stamp Tax (DST) | PHP 30 |

Legal Research Fee | PHP 30 |

PHP 3,310 | |

Business Permit Fees | |

Mayor’s Permit, Business Tax, and Other Local Fees (Quarterly) | PHP 2,500 |

Community Tax (Cedula) | PHP 500 |

Zoning Fee | PHP 100 |

Barangay Clearance | PHP 1,000 |

Business Plate | PHP 500 |

Comprehensive Liability Insurance | PHP 1,570 |

PHP 6,170 | |

BIR Registration Fees | |

Annual Registration Fee | PHP 500 |

BIR Certification Fee | PHP 115 |

DST on Shares (e.g., subscribed x (2/2000)) | PHP 5,000 |

DST on Lease (e.g., virtual office at PHP 24,000 per year) | PHP 960 |

Books of Accounts | PHP 300 |

Official Receipts and Invoices (e.g., 10 booklets) | PHP 5,000 |

PHP 11,875 | |

Miscellaneous Fees | |

Notary, Transportation, Printing Fees, etc. | PHP 20,000 |

Other Expenses and Purchases | |

Stock and Transfer Book (STB) | PHP 470 |

Dry Seal | PHP 2,500 |

Frames for Certificates and Permits | PHP 500 |

Flash Drive | PHP 350 |

PHP 3,820 | |

Corporate Bank Account Initial Deposit | PHP 50,000 |

Total Business Registration Fees (Estimated Grand Total) | PHP 95,175 |

Please note that fees may vary depending on many factors such as city ordinances and regulations, availability of own resources, and bank preferences. For example, business processing fees may differ across cities due to additional licenses and permits. Miscellaneous fees can also be lower depending on your location, notary fees, and printer availability. Additionally, some banks offer corporate bank accounts with an initial deposit requirement as low as PHP 10,000.

Business Registration Documents

Before you begin your business registration, take a moment first to review this list of documents that you will need to secure from various government agencies. All of these will serve as proof of your business registration and legal compliance.

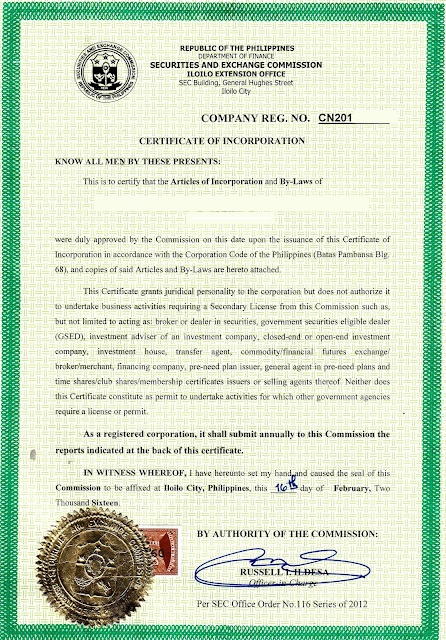

SEC Registration Documents

Your SEC registration legitimizes your company as a juridical unit and permits it to participate legally in business, issue receipts, trade with financial assets, and be entitled to the rights under the nation’s corporate and investment laws. After registration, the SEC will issue you the following documents:

- Cover Sheet

- Reserved Company Name

- Articles of Incorporation (AOI)

- Company Bylaws

- Treasurer’s Affidavit

- Purchased and Registered Stock and Transfer Book (STB)

- SEC Certificate of Incorporation (for corporations)

- SEC Certificate of Recording (for partnerships)

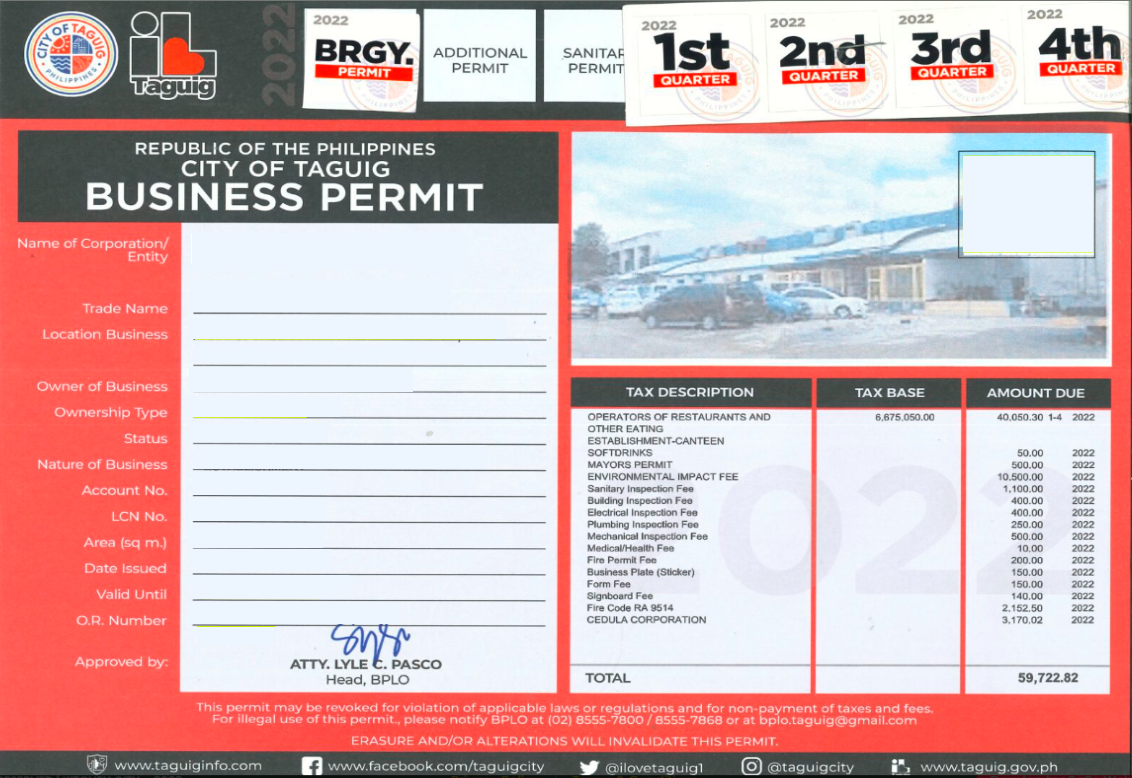

Business Permits and Other Documents

After registering with the BPLO, you will receive a Mayor’s Permit or Business Permit, along with other documents that confirm your payment of local business taxes and compliance with local ordinances related to safety, security, health, and sanitation, among others.

- Barangay Business Clearance or Certificate

- Barangay Business Plate

- Locational and/or Zoning Clearance

- Fire Safety Inspection Certificate (FSIC)

- Sanitary Permit to Operate

- Insurance Policy

- Community Tax Certificate (Cedula)

- Business Tax Assessment and Official Receipt

- Business Permit or Mayor’s Permit

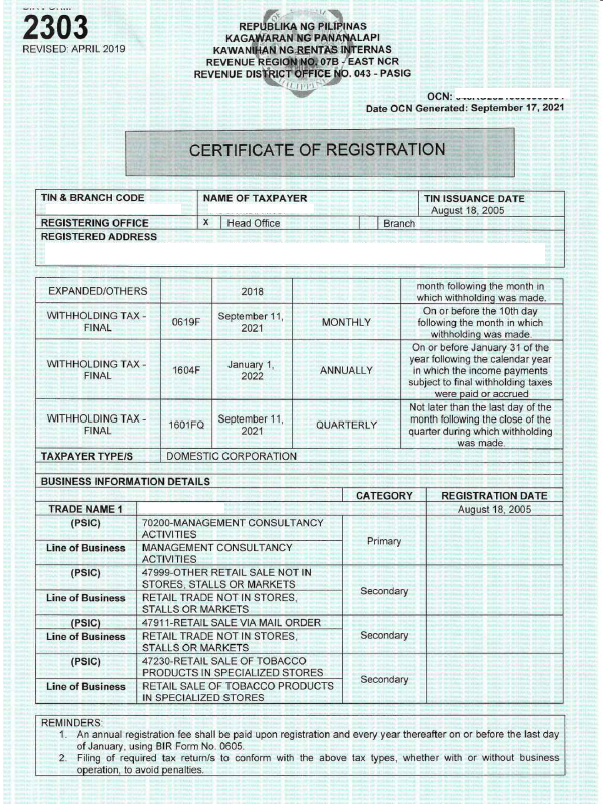

BIR Registration Documents

Upon your successful registration, the BIR RDO will issue your business a registered Taxpayer Identification Number (TIN), together with other documents for your tax filing and compliance purposes.

- Stamped BIR Form 1903 (Application for Registration)

- Authority to Print Receipts and Invoices (ATP) Certificate (BIR Form 1921)

- Annual Registration Form (BIR Form 0605)

- BIR Form DST 2000 (Lease)

- BIR Form DST 2000 (Stock Subscription)

- Primary and Secondary Receipts and Invoices

- Stamped Books of Accounts

- Notice to Issue Receipts and Invoices (NIRI)

- BIR Certificate of Registration (BIR Form 2302)

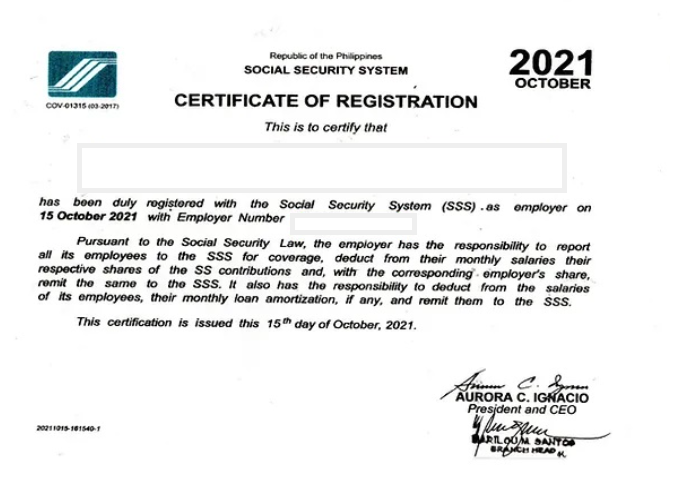

SSS Registration Documents

Your SSS employer registration proves your business compliance with the Social Security Act of 2018 (R.A. 11199) and promotes a sense of contribution to the broader social protection of the workforce in the private sector. After registering with SSS, you will receive:

- Stamped SSS Form R-1 (Employer Registration Form)

- Stamped SSS Form R-1A (Employment Report)

- Stamped SSS Form L-501 (Specimen Signature Card)

- SSS Blue Card

- My.SSS Employer Account

- SSS Certificate of Registration (COR)

PhilHealth Registration Documents

With your PhilHealth employer registration, you can provide health insurance coverage to your employees and comply with the National Health Insurance Act of 1995 (R.A. 7875). After registering, you will receive:

- Stamped ER1 (PhilHealth Employer Data Record)

- Stamped ER2 (PhilHealth Report on Employee-Members)

- Stamped Specimen Signature Form

- PhilHealth Electronic Premium Reporting System (EPRS) Account

- PhilHealth Certificate of Registration (COR)

Pag-IBIG Fund Registration Documents

Your Pag-IBIG employer registration is the first step to granting your workers access to the savings programs, housing loans, and other benefits related to home ownership and social welfare. After registering with Pag-IBIG Fund, you will receive:

- Stamped EDF (Employer’s Data Form)

- Stamped Form HQP-PFF-003 (Specimen Signature)

- Pag-IBIG Fund Electronic Submission of Remittance Schedule (eSRS) Account

- Pag-IBIG Fund Certificate of Registration (COR)

Corporate Bank Account Documents

With your corporate bank account, you can efficiently manage your business finances, easily pay taxes, and directly make remittance of statutory contributions. Depending on your preferred bank and account type, you will be issued:

- Checkbook

- Passbook

- Deposit Slip

- Online Banking Account

- Other documents

Business Registration Timelines (Estimated)

While some service providers may promise quick business registration within a week or two, these timelines may not be realistic. Based on our experience, business registration from the SEC to statutory agencies typically takes 3 to 4 months.

Business Registration Timelines (Estimated) | |

SEC Registration | 2 – 3 Weeks |

Business Permit Processing | 2 – 4 Weeks |

BIR Registration | 2 – 6 Weeks |

Employer Registrations (SSS, PhilHealth, Pag-IBIG) | 1 – 2 Weeks |

Bank Account Opening | 2 – 4 Weeks |

Estimated Completion Time (Most Realistic) | 3 – 4 Months |

As mentioned, business permits and BIR registration can be processed simultaneously, the same with the employer registrations across the three statutory agencies. Constant follow-ups on the applications with the respective government agencies are very important. Unforeseen delays and additional requirements may even extend this timeline.

… and you might just need our assistance.

At FilePino, we specialize in both company formation and business registration in the Philippines. Our team has successfully helped thousands of clients, including foreign nationals, foreign business entities, and expatriates, turn their foreign visions into thriving local ventures.

Ready to register your business in the Philippines? Set up a consultation with FilePino today! Call us at (02) 8478-5826 (landline) and 0917 892 2337 (mobile) or send an email to info@filepino.com.

2 Responses

Apply certificate of registration in business

Hi Leahlyn! Thank you for your comment. Could you please clarify which Certificate of Registration (COR) you’re referring to? If you’re looking to register a business, including SEC or DTI registration and other statutory requirements, we would be happy to assist you. Feel free to reach out to us at 0917 892 2337 (mobile) or email us at info@filepino.com for more information on our business registration services.