The Philippines has made significant strides in economic development in recent years, although not as impressive as in other Southeast Asian neighbors, such as Singapore, Malaysia, and Thailand. In 2023, the country boasted a closing growth rate of 5.6%, and there were modest gains in almost all major industries.

In a domino effect, the booming industries, such as business process outsourcing, financial services, tourism, and particularly online gaming, have attracted foreign investors and workers alike to enter the country for business ventures and employment. The job prospects, for instance, have always complemented the lower cost of living, cultural experiences, and vibrant social scenes.

Legal Background

Like in other countries, the entry and admission of foreign nationals into the Philippines, for whatever reason, is a matter of privilege. The Philippine Immigration Act of 1940 (Commonwealth Act 613), also known as “An Act to Control and Regulate the Immigration of Aliens into the Philippines,” serves as a definitive guide on the issuance of visas, exclusion and deportation proceedings, the powers and structures of the Bureau of Immigration (BI), and other documentary requirements that foreign nationals must comply with in order to legally stay, work, practice profession, and conduct business in the Philippines.

Pursuant to Executive Order (EO) No. 98, series of 1998, persons, whether natural or juridical, dealing with all government agencies and instrumentalities, including Government-Owned and Controlled Corporations (GOCCs), and all Local Government Units (LGUs), are mandated to incorporate their Tax Identification Number (TIN) in all forms, permits, licenses, clearances, official papers, and other documents which they secure from these government agencies, instrumentalities, including GOCCs, and LGUs. Thus, those who earn income in the Philippines, both Filipino citizens and foreign nationals, are required to register with the BIR and get a TIN.

In 2019, the Department of Labor and Employment (DOLE), Department of Justice (DOJ), Bureau of Immigration (BI), and Bureau of Internal Revenue (BIR) signed a Joint Guidelines on the issuance of work and employment permits to foreign nationals.

The Joint Guidelines, in the issued Revenue Memorandum Order 28-2019, clarified and harmonized existing regulations on the issuance of appropriate permits and Taxpayer Identification Number (TIN) to all foreign nationals who intend to work, perform specific activities, or render services in the Philippines, whether in the context of an employment arrangement or otherwise.

Employment-Related Permits for Foreign Nationals

While employers can breeze through the right-to-work verifications upon dealing with local employment, hiring foreign employees requires more serious legal documents – work permits and visas. Without these, both employers and foreign nationals can be held legally liable and fined. The foreign nationals may also be imprisoned, deported, or blacklisted. Now, based on the Philippine immigration laws, the following are the employment-related permits available to foreign nationals:

Special Work Permit (SWP)

It is issued by the Bureau of Immigration (BI) to foreign nationals who intend to work, engage in specific activities, or render services in the Philippines outside of an employment arrangement under a tourist visa (9A). It is valid for up to three (3) months, which may be extended for another three (3) months.

Special Temporary Permit (STP)

It is a privilege granted to foreign nationals, allowing them to practice their respective regulated professions (e.g., education, nursing, accountancy, etc.) in the Philippines upon securing the permit from the Professional Regulation Commission (PRC). It also serves as a prerequisite for obtaining an Alien Employment Permit (AEP).

Alien Employment Permit (AEP)

It is a work permit issued by the Department of Labor and Employment (DOLE), through its regional and field offices, to foreign nationals seeking gainful employment in the Philippines, regardless of the nature or duration of employment. Holders of other visas usually require this permit. Pending issuance of an AEP, or with a valid AEP but pending approval of a 9(G) work visa, a Provisional Work Permit (PWP) must be secured first with the Bureau of Immigration (BI).

Provisional Work Permit (PWP)

It is a temporary permit issued by the Bureau of Immigration (BI) to foreign nationals employed or seeking a job in the Philippines. This must be secured and renewed every three (3) months while the long-term working visa is being processed.

Other Special Permits

Foreign nationals intending to work in special industries must apply for special permits with the respective agencies, for example, with the Department of Environment and Natural Resources (DENR) for the geoscience and mining industries, and with the Department of Justice (DOJ) for nationalized or partially nationalized industries.

Tax Identification Number (TIN)

As particularly discussed in the memorandum, foreign nationals, who are planning to work, or engage in trade or business in the Philippines, must first secure a Taxpayer Identification Number (TIN) based on the existing related revenue issuances prior to the application for work permits.

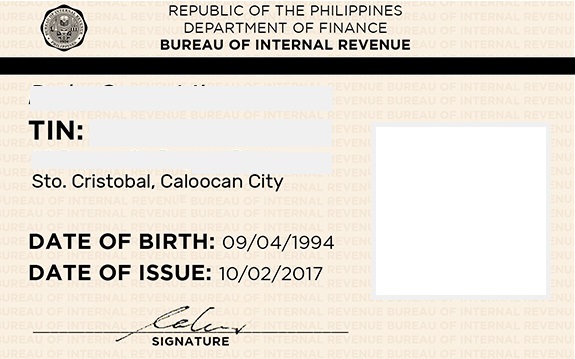

A Tax Identification Number (TIN) is a unique and permanent system-generated nine (9) – digit to thirteen (13) – digit reference index number assigned by the BIR (including a three-digit branch code, if applicable) to individual and corporate taxpayers for identification, tracking, and record-keeping purposes.

It is a vital information for tracing taxable transactions under a computerized system of tax administration. Only one (1) TIN can be assigned per taxpayer regardless of transactions. Taxpayers possessing or using multiple TINs shall be criminally liable under Section 275 of the Tax Code, as amended.

The issued identification card bearing the TIN serves as proof of a taxpayer’s registration with the Philippine Bureau of Internal Revenue (BIR). It contains the holder’s TIN, complete name, address, birth date, picture, and signature.

For foreign nationals, the TIN is issued under E.0. 98 and can only be used for government transactions. Pursuant to the order, it is not allowed for income tax filing purposes, and so the Philippine employer must update the registration information of the employee upon the availability of the AEP or 9(G) pre-arranged employment visa.

TIN Application Requirements and Step-by-Step Process

Filing the TIN application with the Bureau of Internal Revenue (BIR) can be a daunting task, especially for foreign nationals who may have zero knowledge about the domestic laws, bureaucracy in the government, and related processes.

1. Prepare the Documentary Requirements.

Filing the application requires the duly accomplished BIR Form 1904 – Application for Registration for One-Time Taxpayer and Person Registering under E.O. 98 and a photocopy of the passport. For Provisional Work Permit (PWP) and Alien Employment Permit (AEP) purposes, an employment contract or equivalent document indicating the duration of employment, compensation, benefits, and scope of duties is an additional requirement. If the application will be filed by an authorized representative, an authorization letter or special power of attorney (SPA) indicating the name of the withholding agent and authorized representative, and a photocopy of a valid government-issued ID of the representative will also be required.

2. File the Application with the BIR.

Once the documentary requirements are ready, proceed to the designated office for registration. This depends on the purpose or type of application.

- For Provisional Work Permit (PWP)/Alien Employment Permit(AEP), the registration must be processed with the Revenue District Office (RDO) having jurisdiction over the physical address of the employer or RDO having jurisdiction over the local residence, in the case of practice of a regulated profession. For those in employment arrangements with large taxpayers (LT), the LT employer or withholding agent will secure the TIN from the RDO and will not use the eREG system.

- For Special Work Permit (SWP), Special Temporary Permit (STP), and other purposes, the application for registration must be filed with the Revenue District Office (RDO) 39 – South Quezon City at Quezon Avenue, Diliman, Quezon City.

3. Receive the TIN Number.

The actual BIR TIN number can be issued on the filing day itself. Depending on the request or as may be deemed necessary by the respective RDO, the identification card may also be issued. A duly accomplished BIR Form 1905 – Application for Registration Information Update/Correction/Cancellation, a copy of 1×1 ID picture, and any valid government-issued ID are usually required for TIN card application.

4. Update or Cancel the TIN, as Necessary.

For example, a foreign national with a Special Work Permit (SWP), who initially processed registration under E.O. 98 and have subsequently been issued a working visa 9(G), is required to transfer registration from RDO 39 to the new RDO with jurisdiction over the place of business or local residence in the practice of a regulated profession. In case of termination of employment, a foreign national must also process the cancellation of TIN. This is to end the presumption of continued employment in the event of a tax investigation. Usually, a foreign national is required to provide proof of repatriation or departure from the country.

Precise, Reliable, and Compliant

We offer expert solutions tailored to your business needs—from bookkeeping and preparing financial statements to managing your BIR tax filings.

Preferential Tax Rates Under Philippine Tax Treaties

Non-resident aliens not engaged in trade or business are issued a TIN for withholding taxes on their income from sources in the Philippines. They may also avail of preferential tax rates under effective Philippine tax treaties by filing a Tax Treaty Relief Application with the International Tax Affairs Division (ITAD). The tax liability will depend on the provisions of the applicable tax treaty, and the entitlement to the tax treaty relief is on a case-to-case basis depending on the facts as represented by the applicant.

Final Thoughts

The required BIR registration and application for Taxpayer Identification Number (TIN) for foreign nationals intending to work, practice their professions, or engage in business and further apply for employment-related permits are the government’s first line of defense against illegal aliens, especially those engaged in the operations of Philippine Offshore Gaming Operators (POGOs) that have recently become controversial as being linked to various criminal activities, including scams, human trafficking, illegal immigration and employment, kidnapping, and other heinous crimes. Equally important, the requirement entails generation of additional taxes from their income earned in the Philippines.

… and you might just need our assistance.

Given the technical and legal requirements and processes that foreign nationals have to deal with, the assistance of an experienced and efficient legal and business consulting firm can guarantee an organized filing of the documentary requirements, timely issuance of the BIR Taxpayer Identification Number (TIN), and an earlier start of legal employment, conduct of business, or practice of profession in the country.

Set up a consultation with FilePino today! Call us at (02) 8478-5826 (landline) and 0917 892 2337 (mobile) or send an email to info@filepino.com.

25 Responses

I had before but I forgot already my number

Hi Rebecca! You may visit your respective Revenue District Office (RDO) for your forgotten TIN number. Should you have any other business concerns, you may reach out to us for assistance. Thank you.

Pwdi makita ang tin #

Hi Julito! Thank you for dropping us a message. Unfortunately, we cannot grant your request, as we do not have access to BIR database. You might want to visit your respective Revenue District Office (RDO) for verification of your TIN.

I want to know what is my TIN number

I want to get the Philippines Tin number

New TIN

How to identify may tin number again I have it before but now I forgot cuz I lose it

Hi Alvin. Thank you for leaving a comment. You may visit your respective RDO for your TIN verification and issuance of a replacement TIN ID.

Can I register tin id

Hi Deligen! Yes, please feel free to give us a call so we can assist you with the processing of your BIR TIN application. We’re happy to help!

Can I get a TIN ID number

Hi Christian! Yes, you can get a TIN ID number. Kindly tell us how we can help you in the process. Thank you.

Hi

I want to get TIN ID, Can you please help me?

Thanks

Bonifacio L. Benedictos

Hi Bonifacio! Thanks for dropping a comment here. To avail our professional service, kindly call us at (02) 8478-5826 (landline) and 0917 892 2337 (mobile) or send an email to info@filepino.com.

Give me a TIN number NOW! I need it to get deep in debt with a new car!

Hi John! If you’re interested, you can take advantage of our BIR TIN Application Service. Feel free to call us at (02) 8478-5826 (landline) or 0917 892 2337 (mobile), or email us at info@filepino.com for assistance. Thank you!

Pwede po mag apply ng new TIN nr online for foreign nationals? and how po

Hi Elmer! We would be happy to assist you with your BIR TIN application. Please feel free to reach out to us at your convenience by calling (02) 8478-5826 (landline) or 0917 892 2337 (mobile), or you may also email us at info@filepino.com.

What about a permanent resident foreigner in Philippines working for an Australian company? The Australian company has no business location in the Philippines. No work permit is required because the foreigner is not working for a Philippine company?

Hi John! Thank you for your inquiry. May we know what Philippine visa you’re currently holding?

Paano mag rigister or kukuha ng tin number sa online?

Hi Jeven! For online TIN number application and registration, we recommend that you first coordinate with your respective BIR RDO. Alternatively, if you prefer assistance, we’d be happy to help. Feel free to reach out to us at 0917 892 2337 (mobile) or email us at info@filepino.com. Thank you!

I am an investor in a private equity fund and not a resident or a citizen of Philippines. But there is strange requirement that you need to have a TIN number from Philippines. May i know in that case what is the requirement.

Hi Sanjay! Thanks for reaching out. In some cases, the Philippine government requires a Tax Identification Number (TIN) even for non-resident investors, especially if the investment involves local entities or Philippine-source income. Your fund administrator or local partner may be able to assist, or we’d be happy to help. We offer TIN application processing and can also provide tax and legal guidance. Feel free to call us at (02) 8478-5826 or 0917 892 2337, or email info@filepino.com.