“Behind every successful business is a stack of tax forms waiting for attention” — and that underscores a fundamental truth about operating a business. It is not just transforming products and services into profits. It is also about diligent tax compliance.

In the Philippines, taxation is a critical concern, particularly for large corporations and other business entities. The Bureau of Internal Revenue (BIR), the country’s tax authority, employs a comprehensive approach to ensure adherence to tax obligations, i.e., including regular audits, substantial penalties for violations, and increased scrutiny of high-risk sectors.

If you’re planning to incorporate a company, start a business, or pursue self-employment opportunities, you should already be aware by now how the local tax system works. Understanding the nuances of tax compliance can help you make informed decisions regarding your business structure, applicable tax types, and potential tax incentives – prior to processing your BIR registration and obtaining a Certificate of Registration (COR).

While we cannot encompass every aspect of BIR compliance, we’ll provide a detailed explanation of the BIR registration in the Philippines, focusing on the requirements, process, and fees — helpful enough for you to speed up your business launch.

BIR Registration

After registration of a corporation with the Securities and Exchange Commission (SEC) or a sole proprietorship with the Department of Trade and Industry (DTI), it may already be registered with the Bureau of Internal Revenue (BIR) through its Revenue District Office (RDO) having jurisdiction over the principal business address.

The BIR registration provides the authority to (a) formally register a Tax Identification Number (TIN), (b) issue official receipts and invoices, and (c) register the books of accounts that serve as the official records of the business transactions for the fiscal year.

Under the supervision and control of the Department of Finance (DOF), the BIR has the powers and duties “to comprehend the assessment and collection of all national internal revenue taxes, fees, and charges, and the enforcement of all forfeitures, penalties, and fines connected therewith, including the execution of judgments in all cases decided in its favor by the Court of Tax Appeals and the ordinary courts.”

BIR Certificate of Registration (COR)

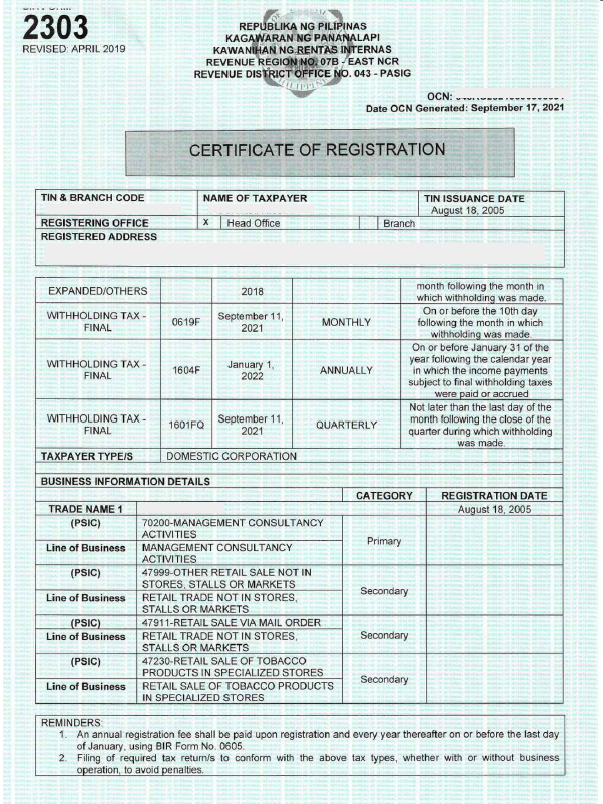

The BIR Certificate of Registration (COR), or the BIR Form 2303, is an official registration document issued by the Bureau of Internal Revenue (BIR) in the Philippines. It is essential for legal compliance, enabling businesses to issue official receipts, pay taxes, and access various government services. It also verifies that a business is registered for tax purposes and includes essential information such as:

Taxpayer Identification Number (TIN)

It is a unique numerical identifier assigned by the BIR to individual taxpayers and businesses. It is essential for various tax-related purposes and transactions, including filing tax returns, opening bank accounts, and obtaining other business permits and clearances.

Business or Taxpayer’s Name

It is the name of the individual (natural person), business, or any entity registered with the BIR, i.e., also with the DTI or SEC. If the taxpayer is a sole proprietor, freelancer, or consultant, it is the full personal name. Corporations are also registered based on their SEC-registered names.

Registration Date

It marks the official date of BIR registration of a natural person or entity. It is a crucial reference for submitting additional BIR requirements (e.g., stamping of receipts, invoices, and books of accounts, days after the registration date).

Registered Address

It specifies the exact physical (or possibly virtual) address of the individual taxpayer or location of the business. It must be accurate, as it determines the BIR Revenue District Office (RDO) jurisdiction and where the official correspondence will be sent.

Registering Office

It simply identifies if the taxpayer is registering either a head office or branch. While a head office is a principal place of business indicated in registration documents, a branch is usually a separate establishment where sales transactions, if any, are conducted independently.

Tax and Form Types

It contains a table that specifies the applicable tax types (e.g., income tax, value-added tax, corporate gains tax, withholding tax, etc.), form types (e.g., 1701, 1702Q, 2550M, etc.), and tax return filing dates.

Business Information Details

It specifies both primary and secondary lines of business (e.g., management consultancy activities, retail trade, labor recruitment, etc.) the taxpayer has been registered to pursue together with the corresponding Philippine Standards Classification Code (PSIC).

Trade Name

It identifies trade names that taxpayers use for business purposes. Sole proprietorships may wish to trade under different names and not their own personal names. Corporations and other business entities may also register and use additional trade names.

Additional Remarks and Reminders

It includes any special notes or instructions relevant to the registration or specific tax obligations. It may also highlight particular compliance requirements or reminders.

Taxpayers Who Require BIR Registration

Taxpayers Who Require BIR Registration

All business entities, i.e., sole proprietorships, partnerships, corporations, etc., require BIR registration, not just for legal compliance and operational efficiency but also for enhancing credibility and enabling growth.

Sole Proprietorships

They represent the simplest and most straightforward business structure where the single owners or proprietors retain all profits, assume all losses, and take liability for all business debts and obligations.

Partnerships

They consist of two or more natural persons or entities, known as partners, who collaborate by sharing their material and non-material resources and distributing responsibilities, gains, and losses.

Corporations

They are juridical entities separate and distinct from their owners and are usually subject to stringent regulatory requirements, such as financial reporting and strict compliance with the corporate laws and regulations.

One Person Corporations (OPCs)

They are also corporations, however with single owners or stockholders who enjoy the combined benefits of limited liability and simplicity of a sole proprietorship.

Cooperatives

They are autonomous and duly registered associations of persons formed out of a common bond of interest to achieve certain social, economic, and cultural needs through a jointly-owned and democratically-controlled enterprise.

Professionals and Freelancers

Generally, they are self-employed individuals who earn remuneration by rendering professional services. They can be practicing licensed professionals, such as doctors or lawyers, or freelancers, such as writers and graphic designers.

BIR Registration Requirements

The documentary requirements for BIR registration depend primarily on the business structure (always check the BIR official website or contact your respective RDO for updates).

Sole Proprietorships and Professionals

Below are the documentary requirements for BIR registration of sole proprietorships, professionals, and self-employed individuals:

- BIR Form 1901 – Application for Registration (for self-employed single proprietors or professionals, mixed-income individuals, non-resident aliens engaged in trade or business, estates, and trusts)

- BIR Form 1906 – Application for Authority to Print Invoices (for printing of receipts, if applicable)

- BIR Form 1905 – Application for Registration Information Update, Correction or Cancellation (for registration of the books of accounts)

- DTI Certificate of Registration

- Occupational Tax Receipt (OTR) form the City or Municipal Hall (for freelancers, if applicable)

- A valid government-issued ID (e.g., PRC, driver’s license, passport, etc.)

- Notarized Contract of Lease, Affidavit of No Rent, Copy of Property Title (whichever applies)

- BIR-printed receipts and invoices (for purchase) or final and clear samples of own receipts and invoices (for printing by a BIR-accredited partner)

- Books of Accounts (general journal, general ledger, etc.)

Partnerships and Corporations

Below are the documentary requirements for BIR registration of partnerships and corporations:

- BIR Form 1903 – Application for Registration (for corporations, partnerships, including GAIs, LGUs. cooperatives and associations)

- BIR Form 1906 – Application for Authority to Print Invoices (for printing of receipts, if applicable)

- BIR Form 1905 – Application for Registration Information Update, Correction or Cancellation (for registration of the books of accounts)

- Photocopy of SEC Certificate of Incorporation (for corporations) or Certificate of Recording (for partnerships)

- Articles of Incorporation (for corporations) or Articles of Partnership (for partnerships)

- Photocopy of License to Do Business in the Philippines (for foreign corporations)

- Board Resolutions and Secretary’s Certificates

- Notarized Contract of Lease, Affidavit of No Rent, Copy of Property Title (whichever applies)

- BIR-printed receipts and invoices (for purchase) or final and clear samples of own receipts and invoices (for printing by a BIR-accredited partner)

- Books of Accounts (general journal, general ledger, etc.)

Cooperatives

Below are the documentary requirements for BIR registration of cooperatives and associations:

- BIR Form 1903 – Application for Registration (for corporations, partnerships, including GAIs, LGUs. cooperatives and associations)

- BIR Form 1906 – Application for Authority to Print Invoices (for printing of receipts, if applicable)

- BIR Form 1905 – Application for Registration Information Update, Correction or Cancellation (for registration of the books of accounts)

- Photocopy of CDA Certificate of Registration

- Articles of Cooperation

- Notarized Contract of Lease, Affidavit of No Rent, Copy of Property Title (whichever applies)

- BIR-printed receipts and invoices (for purchase) or final and clear samples of own receipts and invoices (for printing by a BIR-accredited partner)

- Books of Accounts (general journal, general ledger, etc.)

Additional BIR Registration Requirements, if applicable:

Depending on the business structure and other circumstances, the following may also be required;

- Work visa (9g) for foreign nationals

- Franchise documents and agreements, if a franchise business

- Memorandum of Agreement for joint ventures

- Certificate of Authority, if registered as a Barangay Micro Business Enterprises (BMBE)

- Proof of Registration or Permit to Operate from the BOI, BOI-ARMM, PEZA, BCDA, TIEZA, TEZA, SMBA, etc

- Special Power of Attorney (SPA) and any government-issued ID, if through an authorized personnel

BIR Registration Process in the Philippines (Online and Onsite Guide)

Currently, there are two ways to process BIR registration — onsite or in-person at the BIR Revenue District Office (RDO) and online via NewBizReg Portal.

1. Gather All Documentary Requirements.

Photocopy the business registration documents and all other requirements. Download the applicable forms from the BIR official website and fill them out with accurate information, in duplicate or triplicate copies, as required. Other supporting documents, such as secretary’s certificates and SPAs, if any, also normally require notarization.

For online BIR registration, all drafted and gathered documentary requirements must be scanned. Ensure that all details are clear and always follow the BIR-required formats, if any, for document soft copies.

2. File the Application with the BIR RDO (or Online Via NewBizReg).

Determine the Revenue District Office (RDO) or the BIR sector that has jurisdiction over the registered business address. While RDOs are not directly identifiable by cities and municipalities, search the specific RDO on the official website of BIR. Proceed to filing the application for registration.

For online BIR registration, visit the NewBizReg Portal accessible via the BIR official website. Fill out the online registration form and upload the scanned documents. Online applications are usually processed manually within three (3) working days from the date of email acknowledgement receipt of complete requirements.

3. Pay the Registration Fees.

In most cases, registration fees, including the documentary stamp taxes on shares and rent, are paid first. Simply attach the receipts to the application as proof of payment.

For online BIR registration, online payments for the documentary stamp tax (DST) may also be made online via the BIR ePayment channels. Taxpayer-applicants without an existing TIN should wait for an email instruction on when to pay or may pay DST at the New Business Registrant Counter at the BIR RDO upon pickup of BIR Certificate of Registration.

4. Receive the BIR Certificate of Registration (COR) and Other Documents.

Depending on the RDO and other circumstances, the registration documents may be released on the same day or after one (1) to five (5) days. These include the BIR Certificate of Registration (COR or BIR Form 2303), Authority to Print Receipts and Invoices (ATP or BIR Form 1921), and Notice to Issue Receipts and Invoices (NIRI).

For online BIR registration, wait for an email regarding the availability of the BIR COR and other registration documents for pickup at the BIR RDO. During the schedule, the ATP and books of accounts stamping, as well as the purchase of receipts and invoices, if applicable, may also be processed simultaneously.

5. Submit the Books of Accounts for Stamping.

As soon as the BIR COR is released, submit the BIR Form 1905 – Application for Registration Information Update, Correction or Cancellation, together with the books of accounts (columnar ledger books) for stamping. This must be made within thirty (30) days from the release of the COR to avoid penalties.

6. Process the Printing of Receipts.

Booklets of receipts and invoices are readily available for purchase at the BIR RDO. However, if you decide to print your own (for customization or branding purposes), the approved Authority to Print Receipts and Invoices (ATP) must be forwarded to the BIR-accredited printing company, which will produce the required primary and secondary receipts.

7. Present the ATP and Printed Receipts for Stamping.

After printing the receipts and invoices, present them to the BIR RDO within thirty (30) days to avoid penalties. Depending on the RDO, either just the ATP or both the ATP and the first and last booklets are subject to stamping.

The estimated timeline for the processing of BIR registration depends on the business entity, the Revenue District Office (RDO), and other factors. For a regular stock corporation, the BIR Certificate of Registration (COR) and other documents may already be secured in fifteen (15) to twenty-five (25) days, i.e., from the date of gathering requirements to submitting the printed receipts for stamping.

8. Ensure Post-Registration Compliance.

BIR registration is just the first step to full legal and tax compliance. Post-registration responsibilities of taxpayers, whether individual or corporate, include displaying the BIR COR and other notices conspicuously at the place of business, issuing copies of official receipts to clients, recording transactions in the books of accounts, preparing and filing tax returns, and remitting the taxes due on time, among others.

BIR Registration Fees

The BIR registration fees vary depending on the type of business structure, size of the rented or leased space, and other factors (always check the BIR official website or contact your respective RDO for updates):

Documentary Stamp Tax on Shares (DST Shares)

For stock corporations, this tax is based on the total value or amount of the company stocks. There is a fee of PHP 2 for every PHP 200 of the issued stock with par value.

Documentary Stamp Tax on Rent/Lease (DST Rent)

If renting or leasing a space, there is also a fee of PHP 3 for the first PHP 2,000 and an additional PHP 1 for every PHP 1,000 in excess of the first PHP 2,000 of the contract value.

Loose Documentary Stamp Tax

There is a PHP 30 fee for the stamp to be affixed to the BIR Certificate of Registration (COR).

Annual Registration Fee (No Longer Required)

Under the EOPT Act, the BIR ceased to collect this fee effective January 22, 2024 for both new business registrants and existing business taxpayers.

Other Fees

Books of accounts and receipts may also be purchased directly from the BIR RDO. Books may cost PHP 60 each, while ten (10) booklets of receipts may be bought at PHP 1,500.

Consequences of Non-Registration with BIR

If a company or business is found operating without BIR registration, it will face a series of consequences, which may include penalties for non-registration, charges of tax evasion, closure of business, imprisonment, and other civil penalties.

While it cannot issue official receipts, it is also ineligible for business loans and other grants, as financial institutions normally require proof of legitimate business operations, including a BIR Certificate of Registration (COR). Read also: 9 Common Taxpayers’ Violations and Their Corresponding BIR Penalties [Plus Tips to Easily Avoid Them].

Common BIR Registration Challenges and Solutions

Here are some of the most common challenges faced by companies and taxpayers during their BIR registration, along with potential solutions:

Incomplete or Incorrect Documentation

Many BIR registrants face delays due to incomplete or inaccurate documents. To avoid this, start with a list of documentary requirements, fill out the forms with accurate information, and review them thoroughly before submission. Equally, it is best to get in touch with the BIR RDO for clarifications and additional information.

Long Processing Times

Although the BIR has already adopted digital systems and streamlined its processes, there can still be instances where the BIR Certificate of Registration (COR) and other registration documents cannot be issued within days. Regular follow-ups with the BIR RDO can help track the application and lessen the frustration caused by long waiting times.

Confusion Over Tax and Form Types

Filling out forms and selecting the appropriate tax and form types require at least basic knowledge about taxation in the Philippines. Although errors in the BIR COR can be rectified, this will take additional processing time and resources. To ensure correct tax and form types, consult with the BIR personnel or other tax professionals.

Navigating Changes in Regulations

Among the government agencies concerned with business registration, it is perhaps the BIR that has been rolling out various systems and frequently changing its policies. The changes in tax laws and BIR regulations can create confusion. To know the latest information, e.g., BIR registration process and requirements, refer to the recent advisories on the BIR official website or contact directly the respective RDO.

In the end, operating a business that is not registered with the Bureau of Internal Revenue (BIR) may lead to various legal and financial consequences. Thus, it is imperative to ensure compliance with the existing laws and regulations concerning business registration and taxation.

With the streamlined BIR Registration process, particularly brought about by the removal of the Mayor’s Permit from the requirements and adoption of digital systems, registrations across different government agencies may be processed simultaneously and smoothly. However, it is still best to anticipate potential bottlenecks. Ultimately, the earlier a taxpayer or business registers with the BIR and other agencies, the more quickly it can be legally promoted and commence operations.

… and you might just need our assistance.

We, at FilePino, offer a BIR Registration Service as part of our company formation and business registration package to local and foreign companies and entrepreneurs seeking market presence in the Philippines. We also provide the same service to individual taxpayers, such as sole proprietors, independent contractors, and professionals. Read more about our Business Registration Service here.

Ready to process your BIR registration? Set up a consultation with FilePino today! Call us at (02) 8478-5826 (landline) and 0917 892 2337 (mobile) or send an email to info@filepino.com.

43 Responses

Can i get tin

Hi Marifel! Thank you for leaving a comment. Could you please provide us with the full details of your inquiry? We’d be happy to assist you!

Hello, pwede po ba makakuha ng BIR Cert of Reg? Gusto ko po sana magsell thru shopee and tiktok and I need this requirements. Hope you can assist. Thanks

Hi Anna! You might want to avail our BIR registration service. Set up a consultation with our business specialists today! Call us at (02) 8478-5826 (landline) and 0917 892 2337 (mobile) or send an email to info@filepino.com.

Hello po! Can i get bir cert of reg? I want to sell in tiktok and shopee but k don’t have a cert of reg bir

to day is thursday time 8:20pm

date: 30/1/25. please help me.

to how can i get the full pacthure of Certificate Registration. i need it. i hope you understand me

Bir

Inquiry

Hi Jeson! Thank you for leaving a comment. Could you please provide us with the full details of your inquiry? We’d be happy to assist you!

Okay

Can i get 2 COR’s? Would that be possible?

Hi Van! Yes, it is possible to obtain two or more BIR Certificates of Registration (COR), but there are factors to consider, such as having multiple businesses, different tax types, or branches. If you could provide more specific details about your BIR registration, we’d be happy to assist you further and help address your concern. Thanks!

Please sent me thank you

I want to get COR and BIR for my bussiness ukay clothes

Hi Leonora! Thanks for dropping a comment. You may reach out to us anytime for BIR registration assistance. Thanks.

Good day!

I want to make a TikTok shop to sell different kind of products .

I hope you can do that for me to have a Bir Certificate to approved my request on TikTok shop.

Thanks a lot

Hi JonJon! Call us at (02) 8478-5826 (landline) or 0917 892 2337 (mobile) or send an email to info@filepino.com. We’re here to assist you!

Thank you

You’re very much welcome, Judelyn!

How can i get my Bir certificate of recognition? It’s for may online small business.

Hi Kate! Thank you for dropping an inquiry. based on RMC 27-2024, online sellers fall under the category of self-employed individuals. If you need additional or specific information, you may coordinate with your respective RDO. You might also want to avail our BIR registration service. Feel free to get in touch with us through our contact details below the post. Thank you.

Good day! I want to make a TikTok shop to sell different kind of products . I hope you can do that for me to have a Bir Certificate to approved my request on TikTok shop. Thanks a lot

Hi Jeck Jeck! Kindly call us at (02) 8478-5826 (landline) and 0917 892 2337 (mobile) or send an email to info@filepino.com to book a consultation and avail our BIR registration service. Thanks.

Need certificate

Hi Heizel! May we have the specific details of your concern or inquiry? Thanks.

Can’t iget BIR certificate of registration for requirements to my online Business

Hi Angel! You might want to avail our BIR registration service. Set up a consultation with FilePino today! Call us at (02) 8478-5826 (landline) and 0917 892 2337 (mobile) or send an email to info@filepino.com.

BIR business permit

Good day! I want to make a TikTok shop to sell different kind of products . I hope you can do that for me to have a Bir Certificate to approved my request on TikTok shop. Thanks a lot

Hi Joan! You might want to avail our BIR registration service. Set up a consultation with FilePino today! Call us at (02) 8478-5826 (landline) and 0917 892 2337 (mobile) or send an email to info@filepino.com.

I need certificate

I have a new business I need an COR from BIR

Hi Ybonne! You might want to avail our BIR registration service. Set up a consultation with FilePino today! Call us at (02) 8478-5826 (landline) and 0917 892 2337 (mobile) or send an email to info@filepino.com.

Bir 2302

Hi Po, I need a Certificate of Registration for TikTok seller

Hi Dairyna! You might want to avail our BIR Registration Service. Call us at (02) 8478-5826 (landline) and 0917 892 2337 (mobile) or send an email to info@filepino.com. Thank you.

Can I get COR?

Hi Glai! Yes, you can, as long as you have the necessary qualifications and requirements. You might also want to avail our BIR registration service. Set up a consultation with FilePino today! Call us at (02) 8478-5826 (landline) and 0917 892 2337 (mobile) or send an email to info@filepino.com.

Can i get bir

Hello po I need a Certificate of Registration for my my business on TikTok seller

i need a certification of registration for my business in tiktok seller

Can I get a BIR to process my sss form

Hello Gordon! Thank you so much for reaching out to us. We’d be happy to assist you further. Could you kindly provide us with the complete details of your concern? At FilePino, we offer assistance with both BIR and SSS Employer Registrations. Feel free to contact us at 0917 892 2337 (mobile) or via email at info@filepino.com. We look forward to helping you!